American Express credit card zero-based application tutorial, accumulate U.S. credit history, and become a U.S. digital immigrant

When it comes to , no one should know it. was founded in 1850, mainly engaged in credit card and traveler's check business.

has always taken a relatively high-end route. Express credit card limits are generally relatively high, and there are many, many different discounts.

In addition, also cooperates with many high-end hotels, such as Hilton/Marriott, and many airlines. We can use American Express points to directly redeem hotels and air tickets without spending a penny. It can be said that there are many ways to play.

This time I applied for an American Express credit card. In addition to the ease of use of its credit card, there is another point:

Preparation before application

First we must become an .

is a concept I proposed, mainly to facilitate those who are temporarily unable to go abroad, but want to experience or enjoy U.S. financial services.

To become a digital immigrant in the United States, there are generally four steps required:

-

To buy a physical , we recommend the PayGo mobile phone card with a monthly fee of 3 US dollars.

-

A , primarily used to accept physical cards for credit cards.

-

The other key is that we need a US tax ID number, which is . Only with can you apply for a US credit card online.

-

Finally, we need to have an independent IP in the United States to simulate the American environment.

For specific application methods, you can click on the link below to learn:

After using it for half a year and having a credit record, you can consider applying for an American Express credit card. This will greatly increase your success rate. Personally, I applied twice before but was not approved. I only got approved after having a credit record of one year.

If the friend in front of the screen has prepared the above content, then you can apply step by step according to my tutorial.

American Express Credit Card Application Tutorial

Let’s first scroll down to the bottom of the page. The country here must be the United States, so that you can apply for an American Express credit card.

American Express has many businesses, including personal business, corporate business, and travel debit card business. Today I will mainly show you how to apply for a personal credit card.

If your English is not good, we can translate the page into Chinese.

First of all, the good thing is that when we fill out the American Express credit card application form, he will not check our credit record. He will only check our credit record when we pass the preliminary review and we are sure to apply.

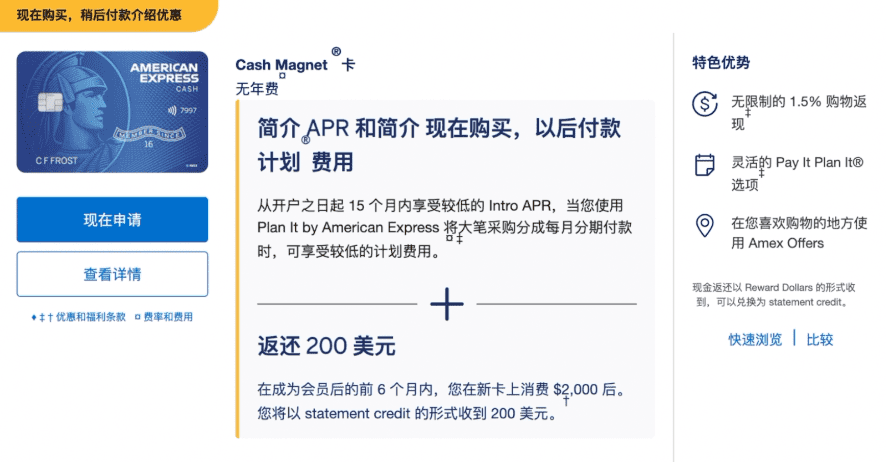

American Express has many types of cards, and different cards have different requirements for credit levels. Newbies are recommended to choose a cash back card that is easier to apply for.

Of course, these cash rebates can only be obtained for consumption in the United States or on U.S. websites. If you bind Alipay and WeChat and consume on some domestic platforms, you will not get this cash rebate.

In addition, when this card is used in non-U.S. areas, there is a 2.7% FTF, which is the overseas consumption fee. If you have overseas consumption needs, I still recommend the credit card.

We click Apply Now.

The entire application process is actually relatively simple.

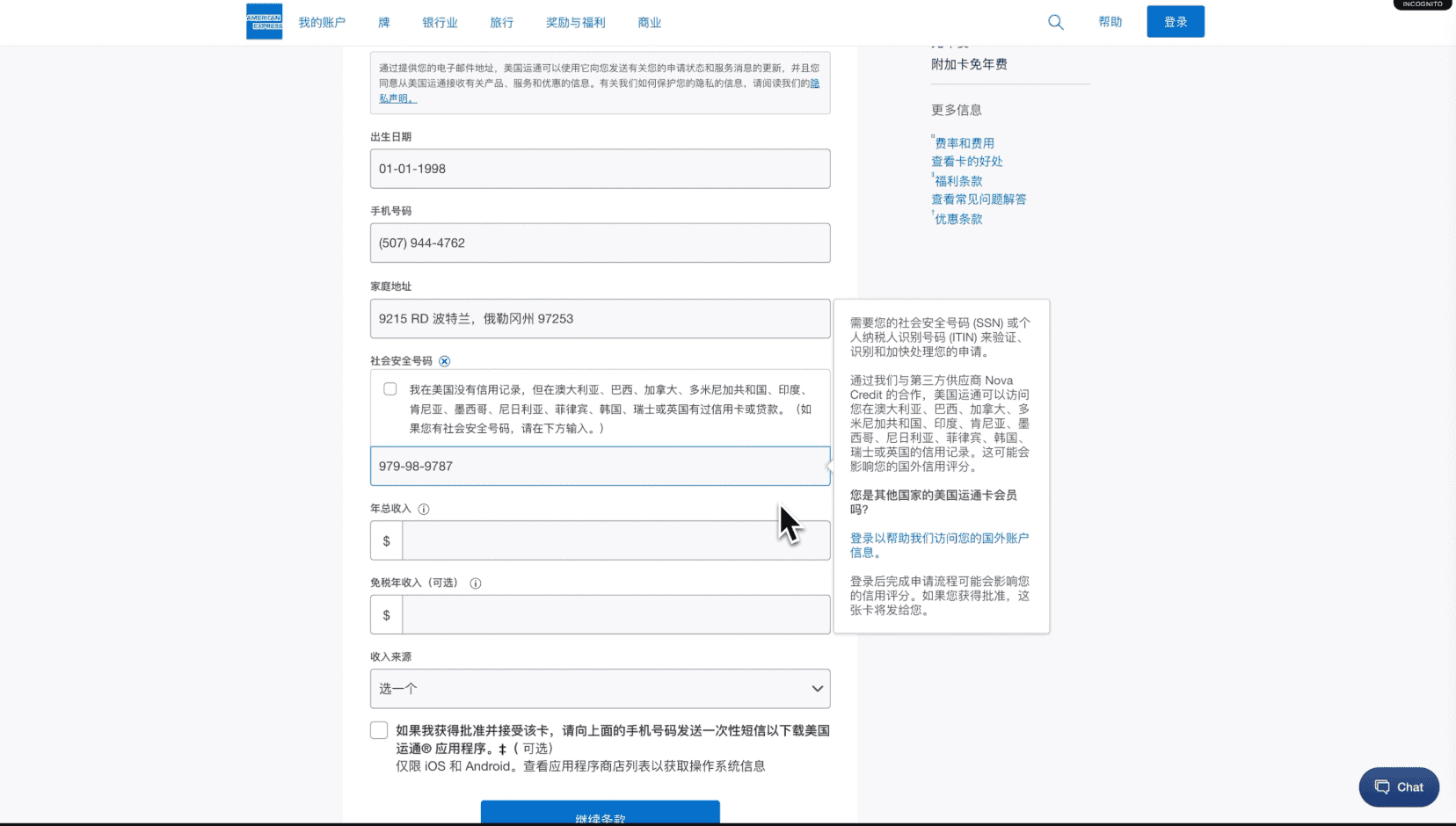

Here we go to fill in our personal information.

It should be noted that everything must be filled in in English. For example, if my name is Zhang San, I will fill in San Zhang and enter my email address below. Next enter your date of birth. Enter your mobile number below.

Next enter a US address.

social Security number. We can directly fill in the US personal tax number here, which is .

Next enter your annual income. We don’t need to fill in the tax-free annual income and choose the source of income. We choose to work. Check the options below and click Continue.

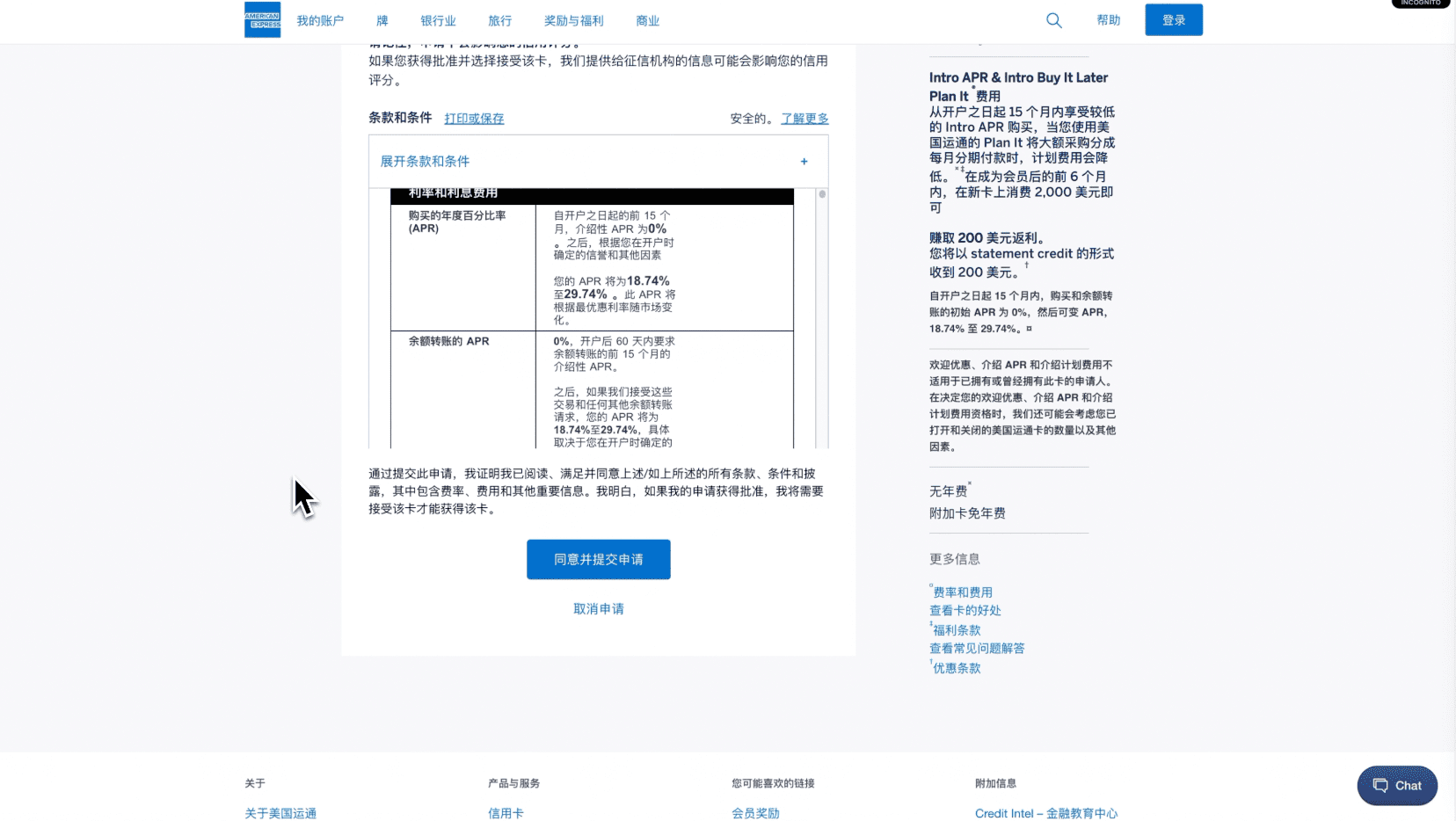

Agree to the terms.

Next, the system will conduct a preliminary review. In the preliminary review, there are three main judgment criteria:

-

Does have a credit history?

-

Is the address ?

-

Are high-risk virtual numbers?

Because I filled in the information randomly, the system will prompt that the application cannot be approved.

But if you have a U.S. credit record and the information is acceptable, the system will then show that it is under review.

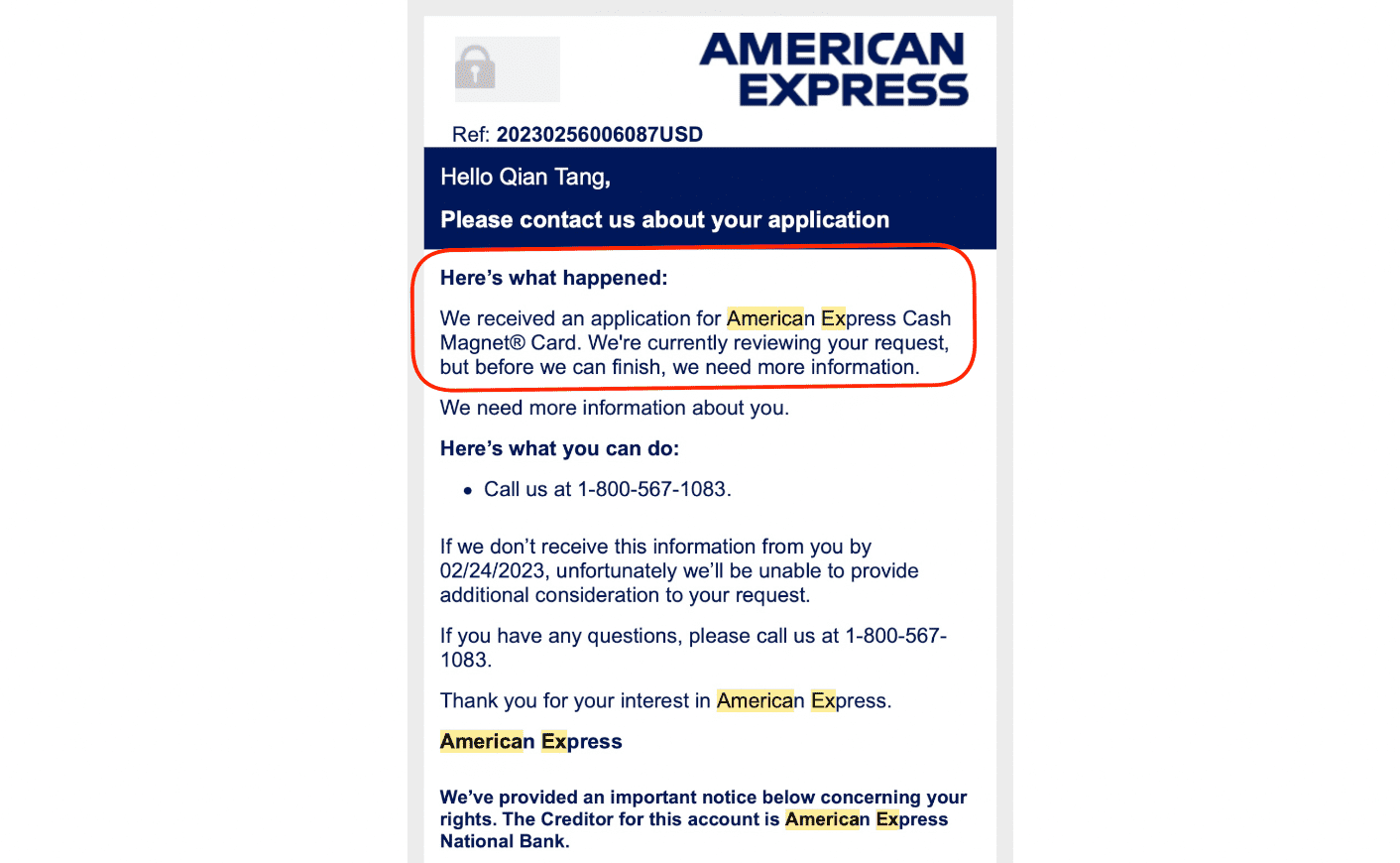

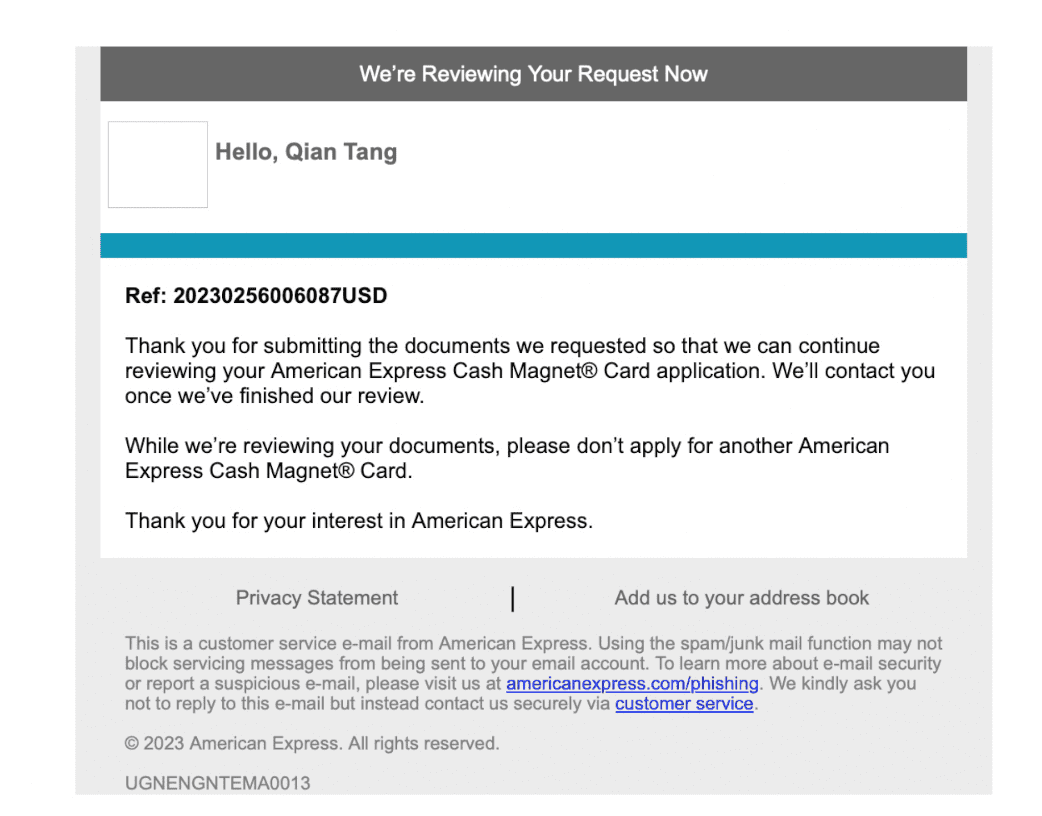

In the same case, we will also receive an email indicating that the system is reviewing our application.

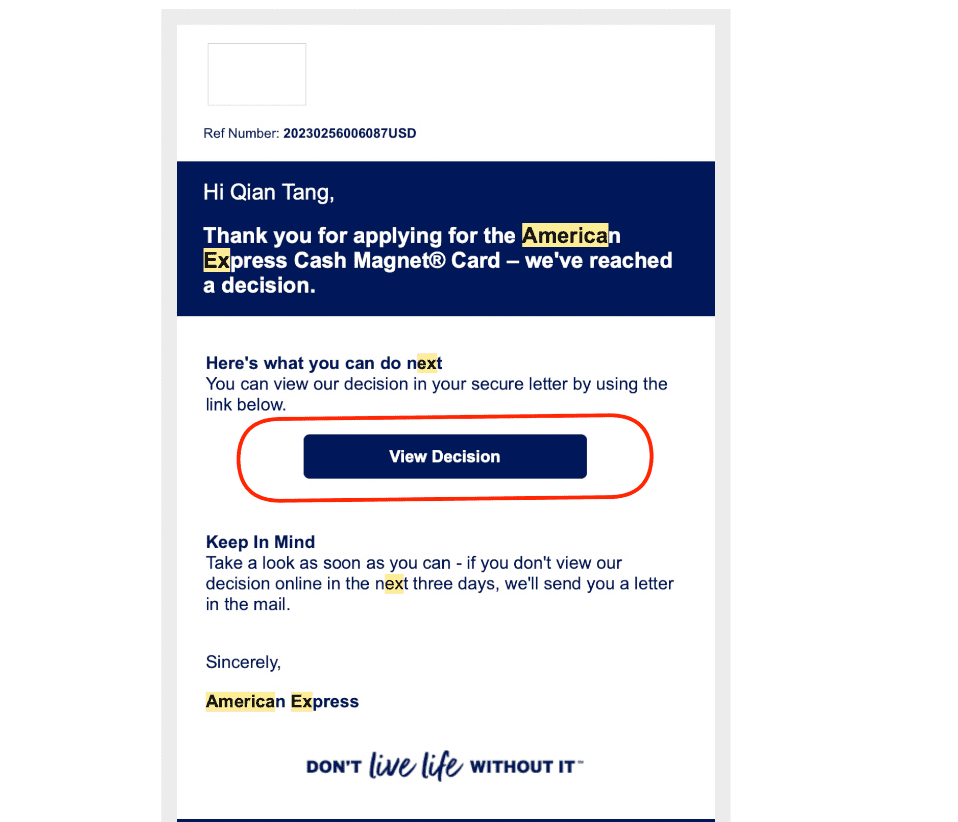

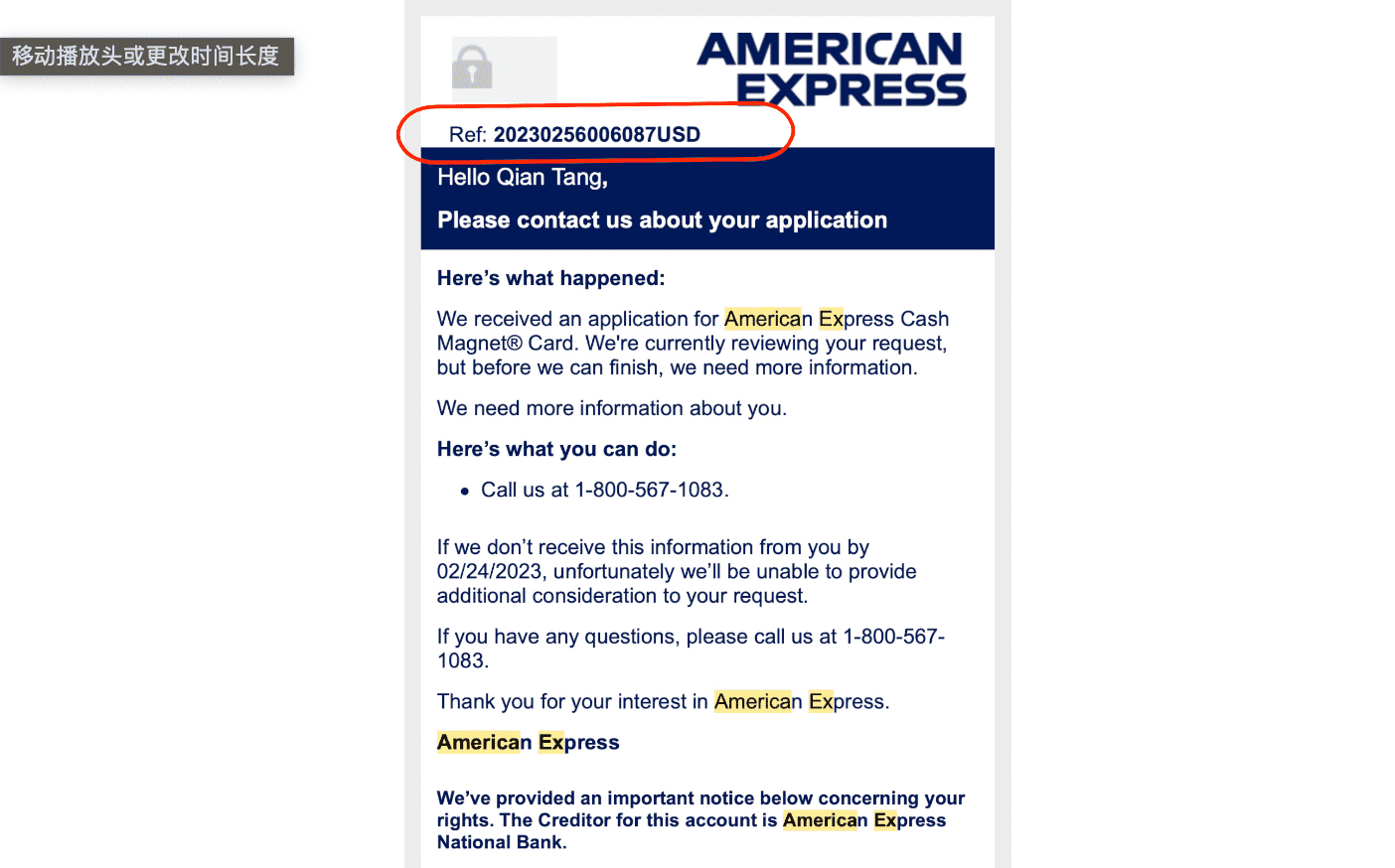

In about a week, we will receive an email with the review results from American Express. There is a link in the email I received.

After clicking in, the system prompts that my application form has been received, but we need to provide more information.

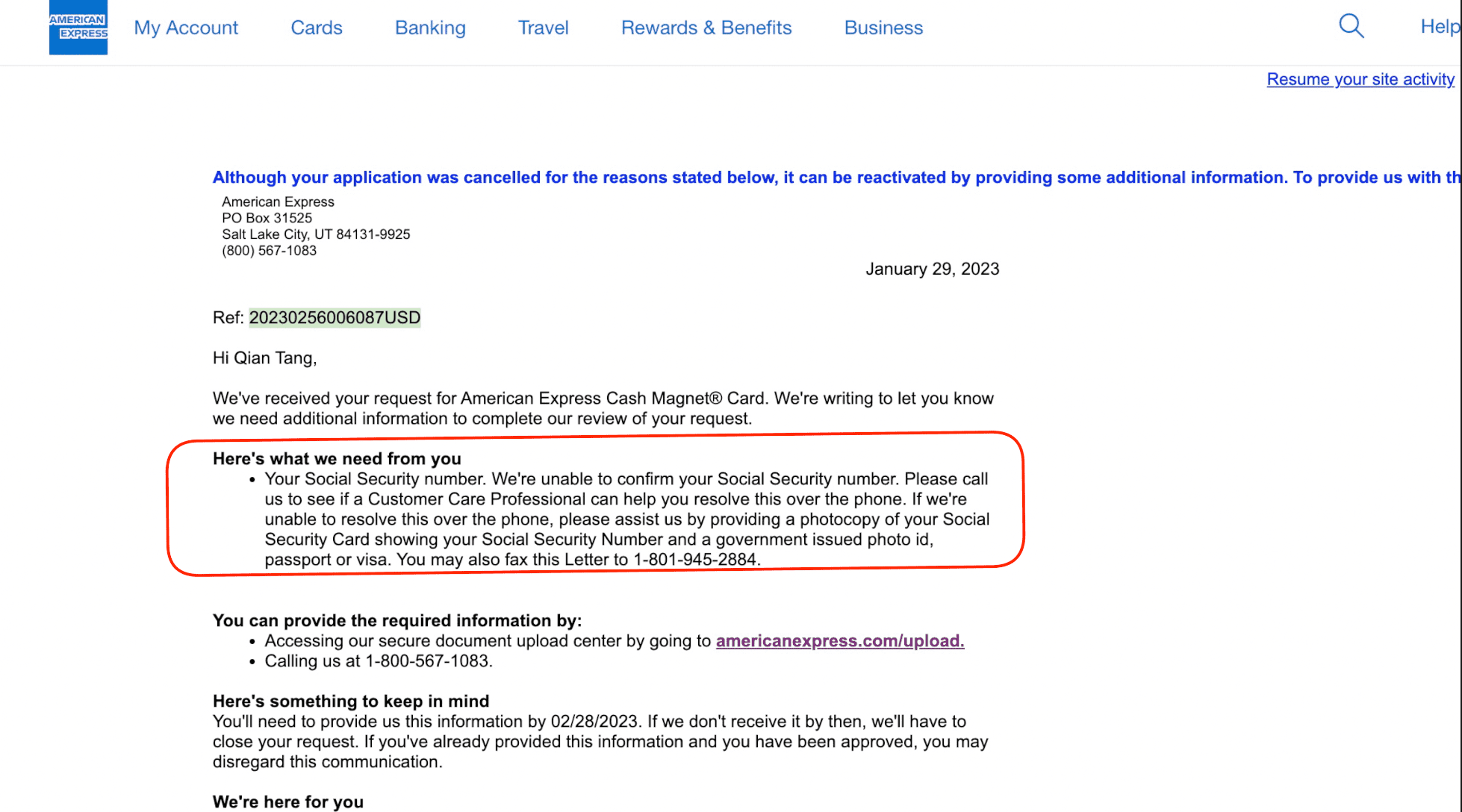

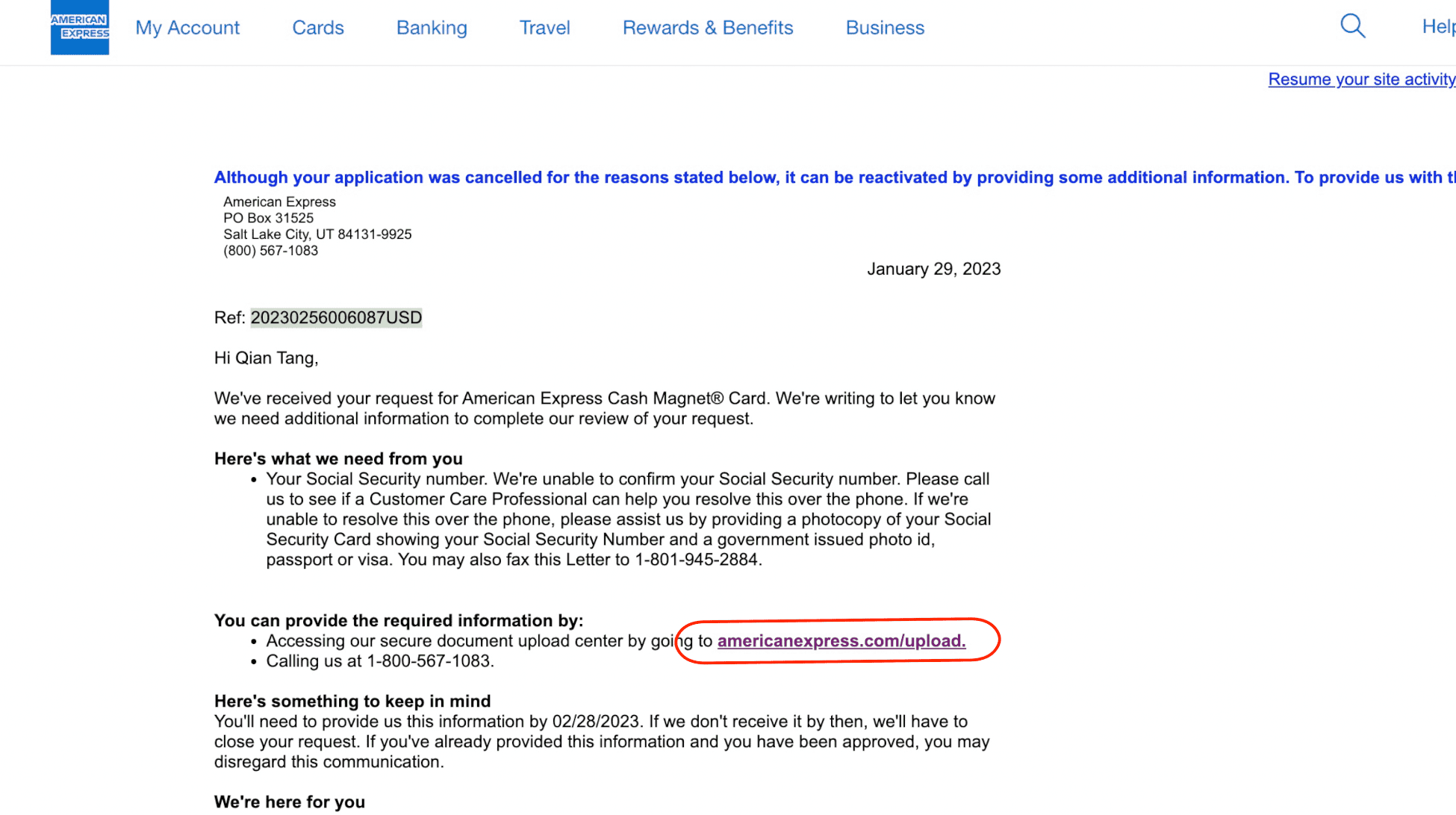

Because we applied using , we were reminded that our social security number cannot be identified. So you need to provide a photo of your Social Security card.

At this time we need to submit three documents.

-

Scanned copy of passport, in order for American Express to verify our identity.

-

The scanned copy of must be consistent with the ITIN filled in on our application form, and it is also for identity verification.

-

The photo of letter is for American Express to verify the authenticity of our address.

Although American Express asks us to submit a photo of our SSN, but we don’t have one, then you can refer to my suggestion and provide the above three information. Under normal circumstances, it can pass the verification.

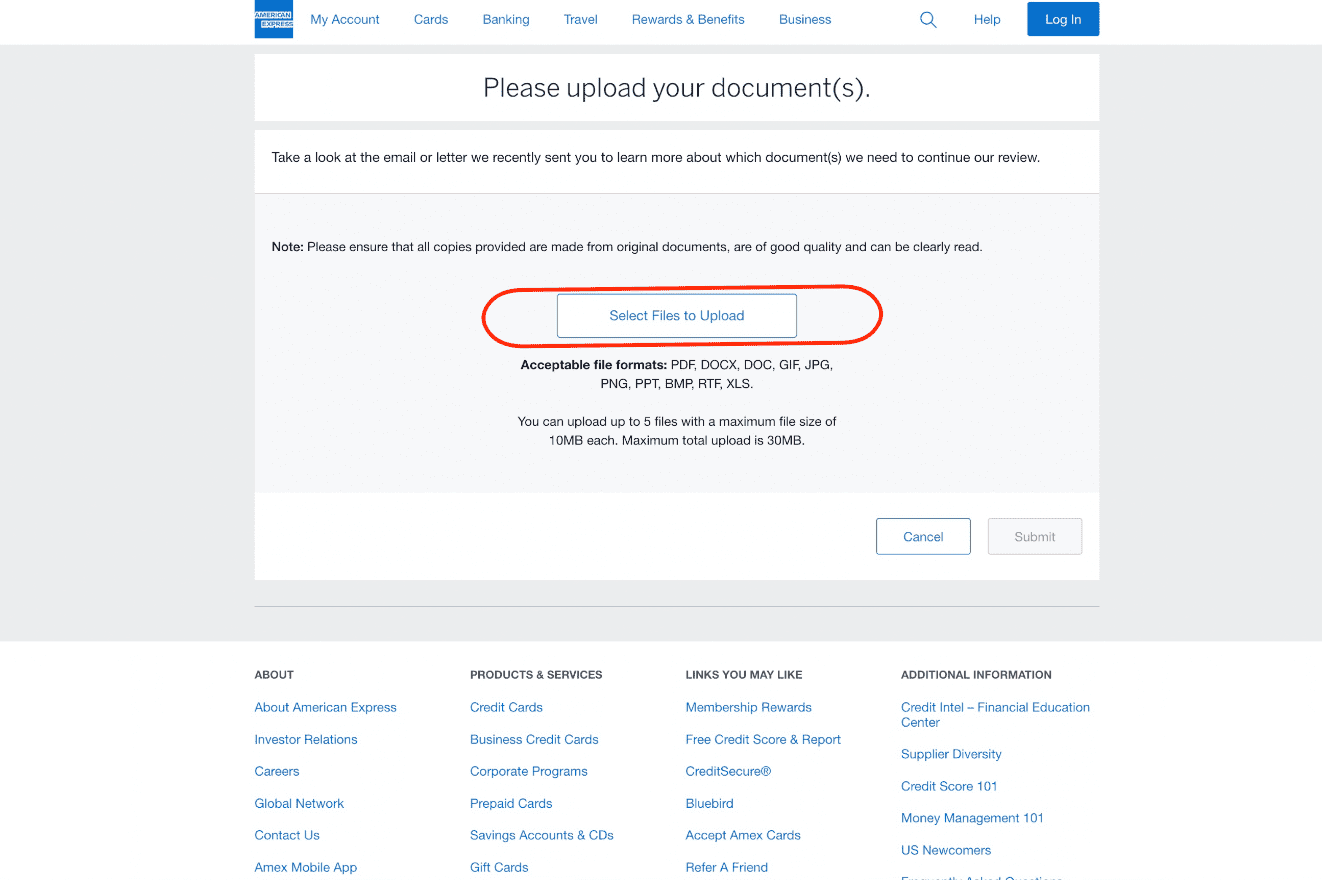

Next, let's click on the upload link.

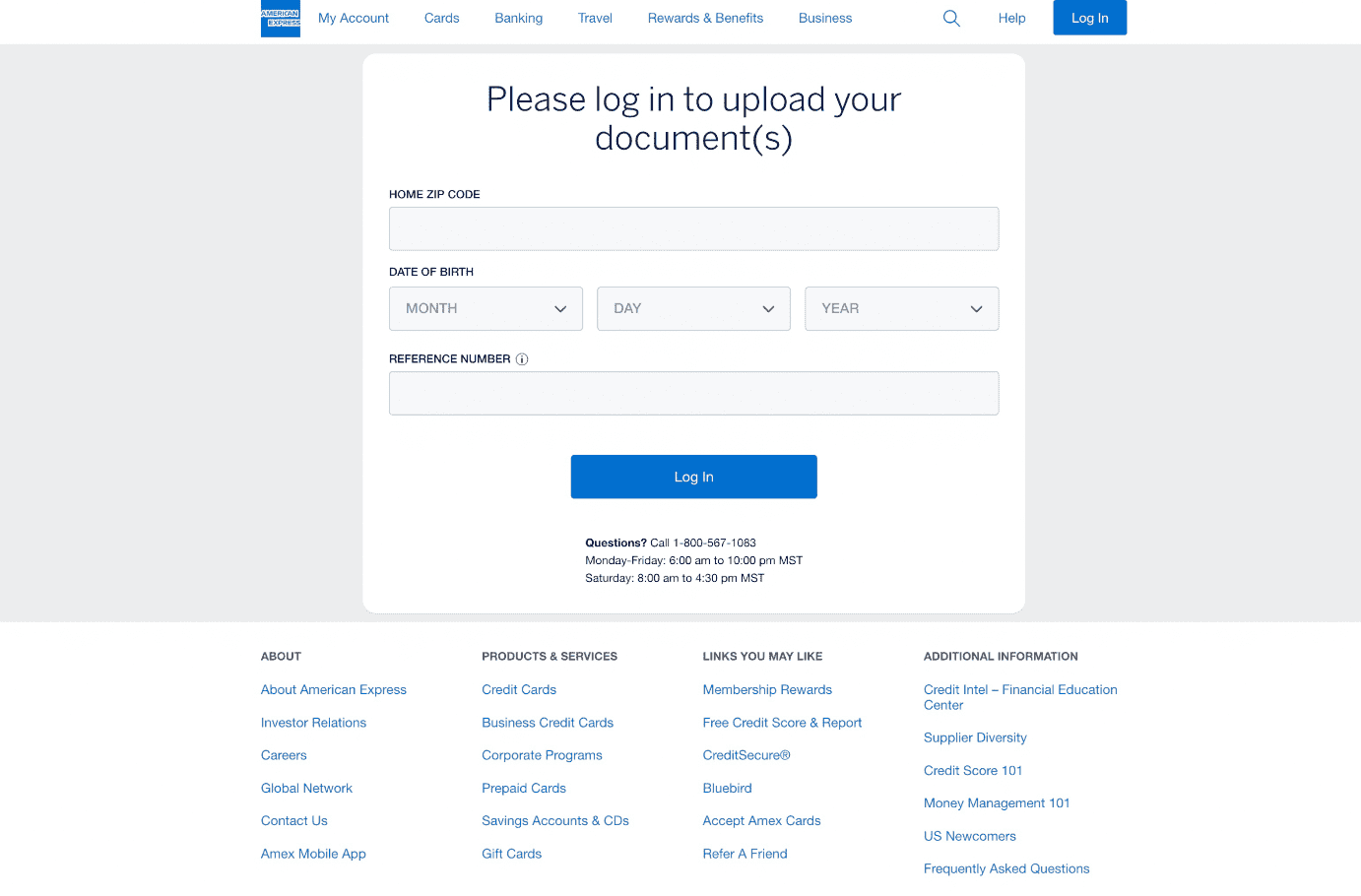

Then enter the information on the application form here.

The main ones are the zip code/date of birth and the application number. If you have the application number, you can find it in the email here.

After filling in, click Login, and then you will go to the upload interface. We can directly select three files to upload.

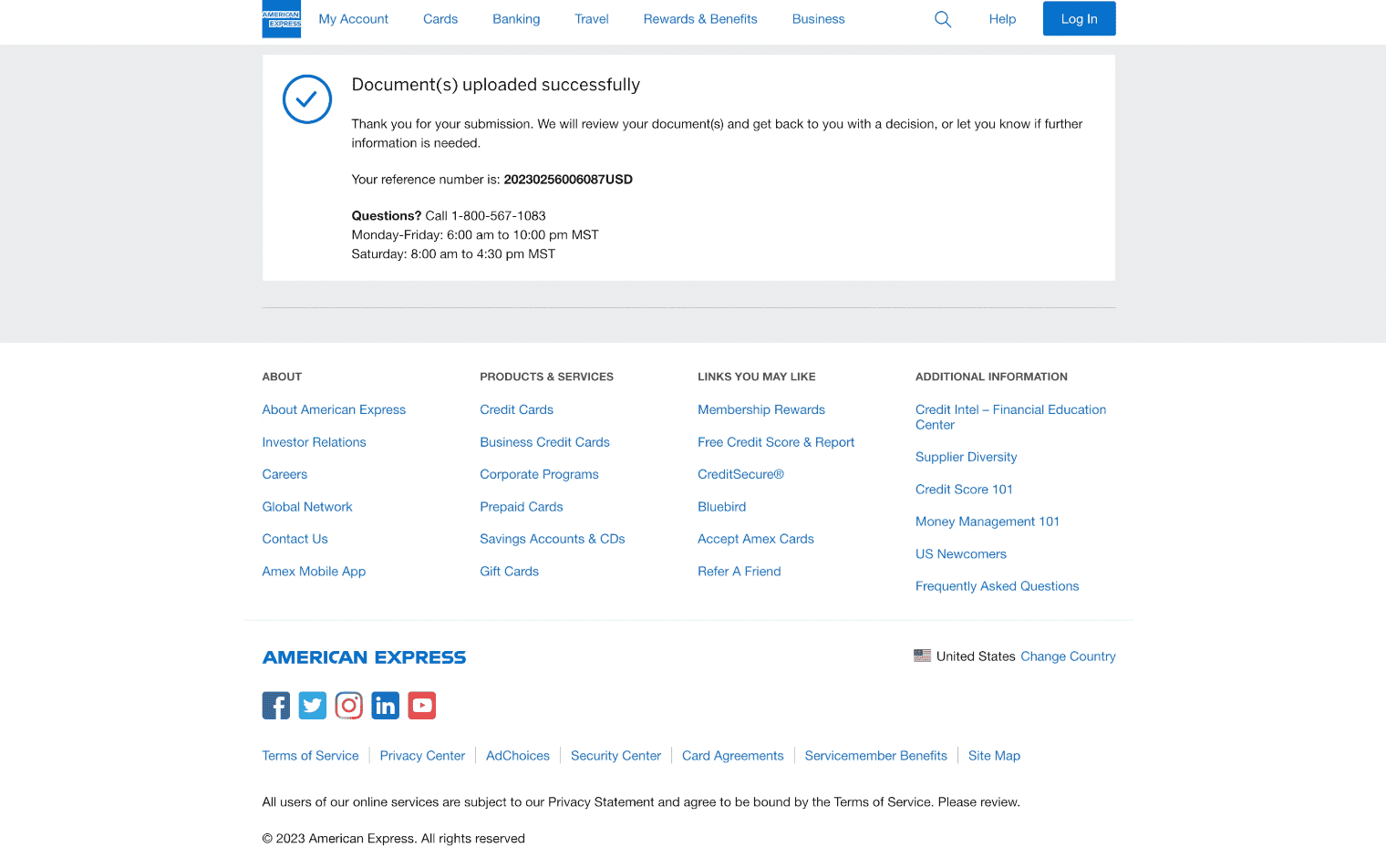

After the upload is completed, we wait for review, which usually takes about a week.

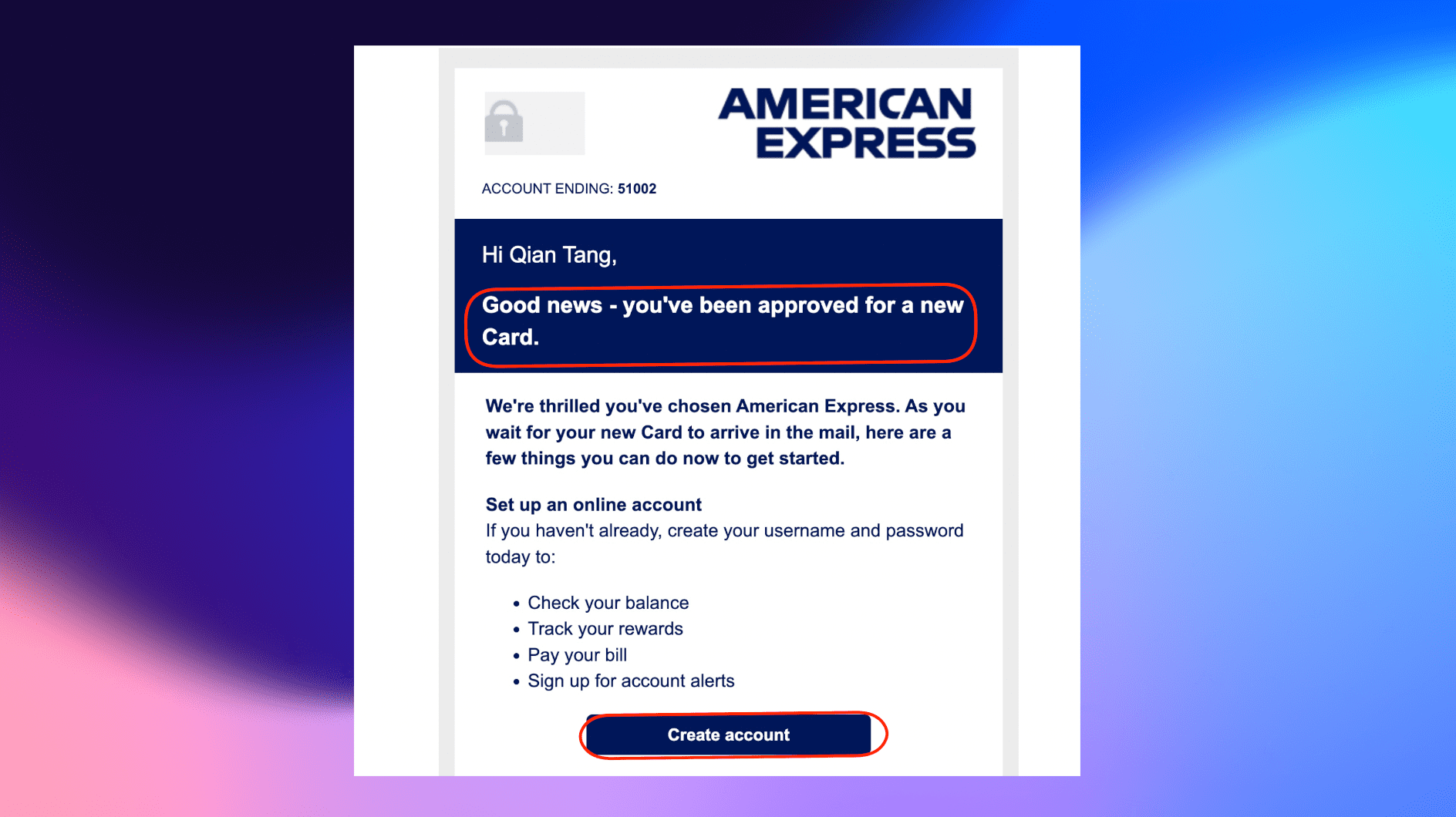

If the review is approved, we will receive an approval letter. Prompt us to create a credit card account for online banking.

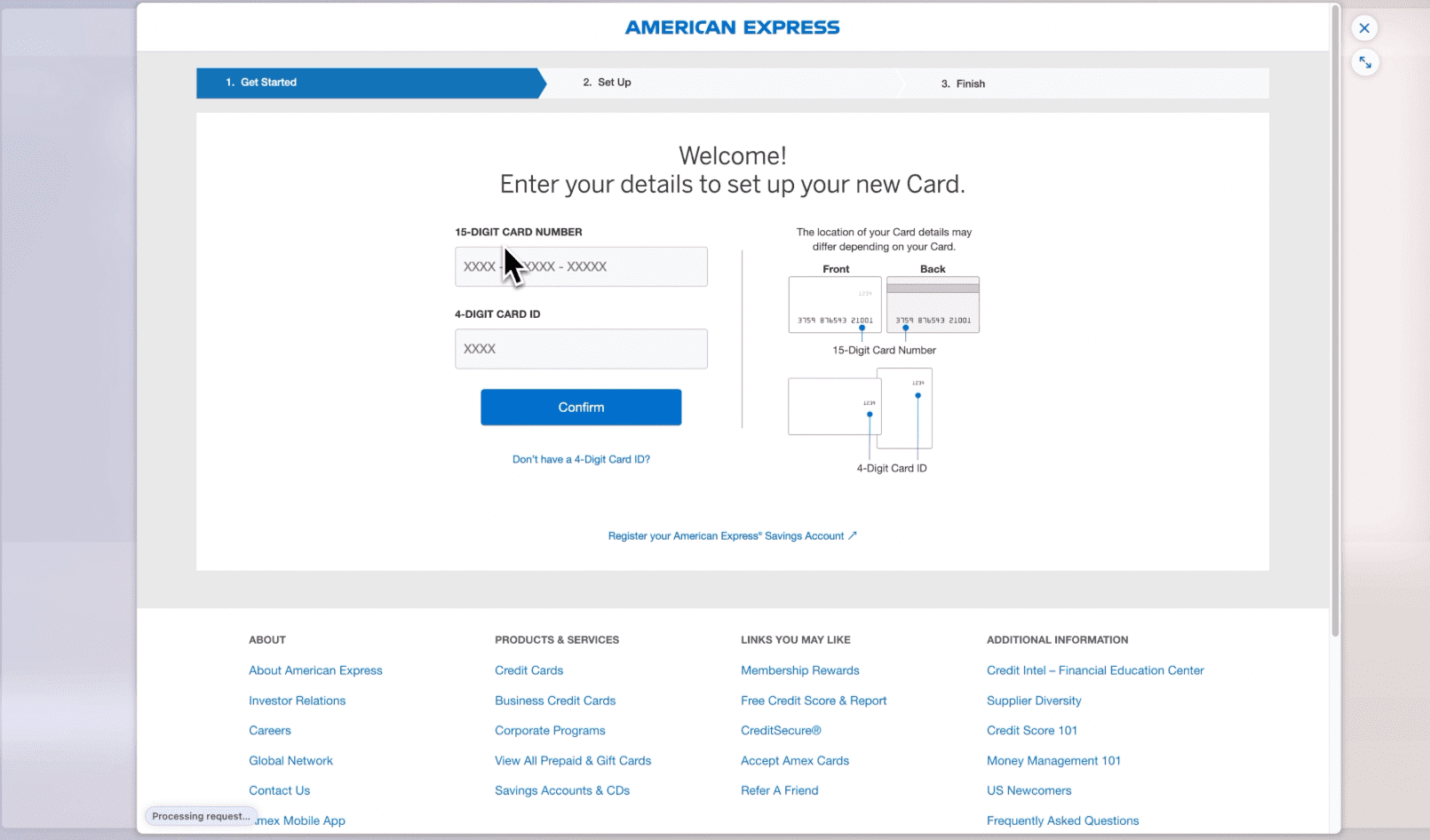

We click Create Account here, and we are prompted to enter the credit card number and credit card verification code, so we can only create an online banking account after receiving the physical card.

Some friends are worried that if they ask to scan the credit card for us, doesn’t he know the credit card information? So will the card be stolen?

I have been using for almost three years. Basically, all the credit cards and bank cards mentioned in my tutorials are scanned and transferred by this service provider. There are not ten, but seven of various cards. Eight of them, and there has never been any theft.

Of course, this is just my personal experience and is for your reference only.

After receiving the card and registering the account information, you can log in.

American Express Credit Card Online Banking Tutorial

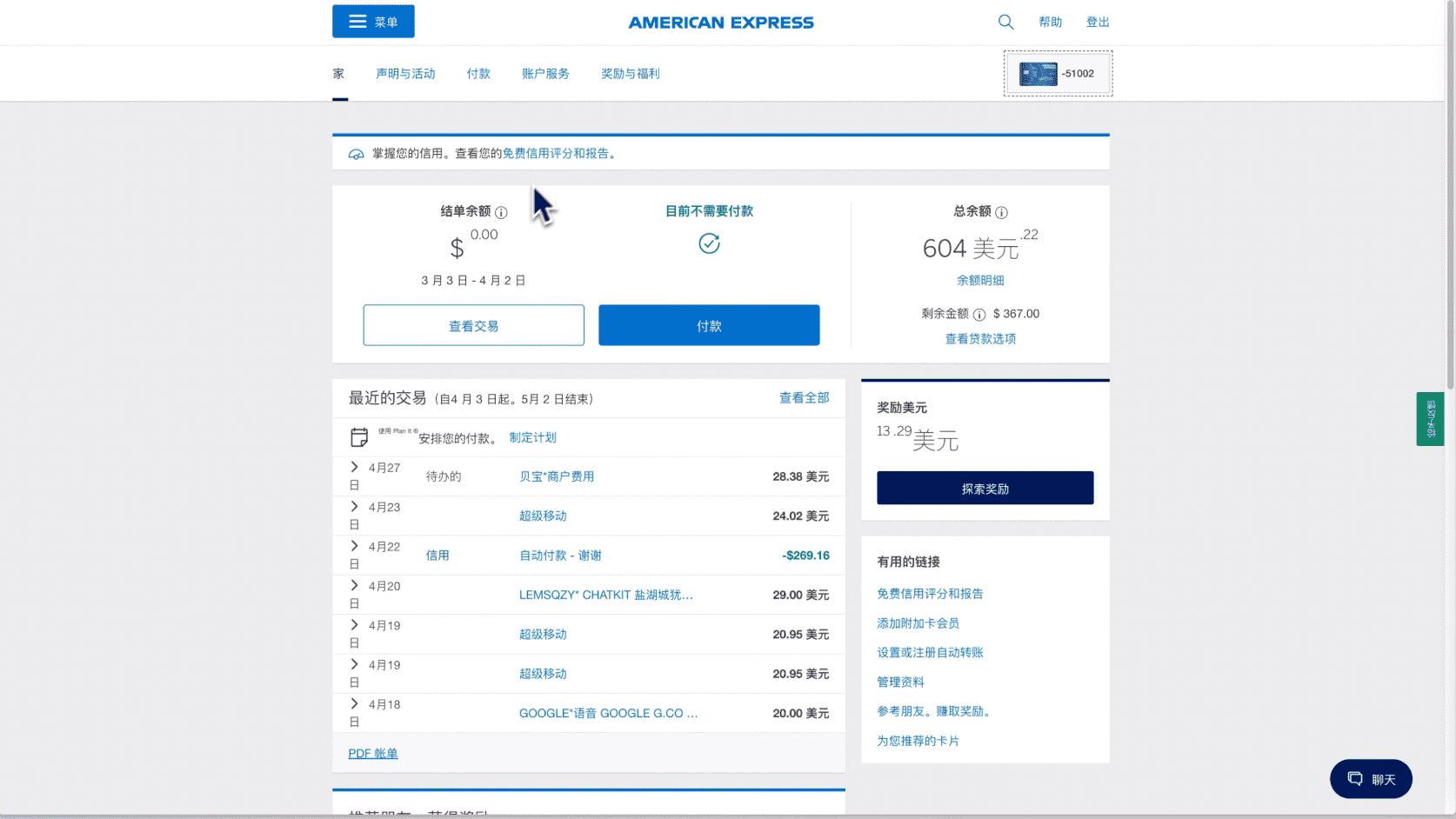

After logging in to the backend, friends who don't speak English can still use the browser to translate into Chinese.

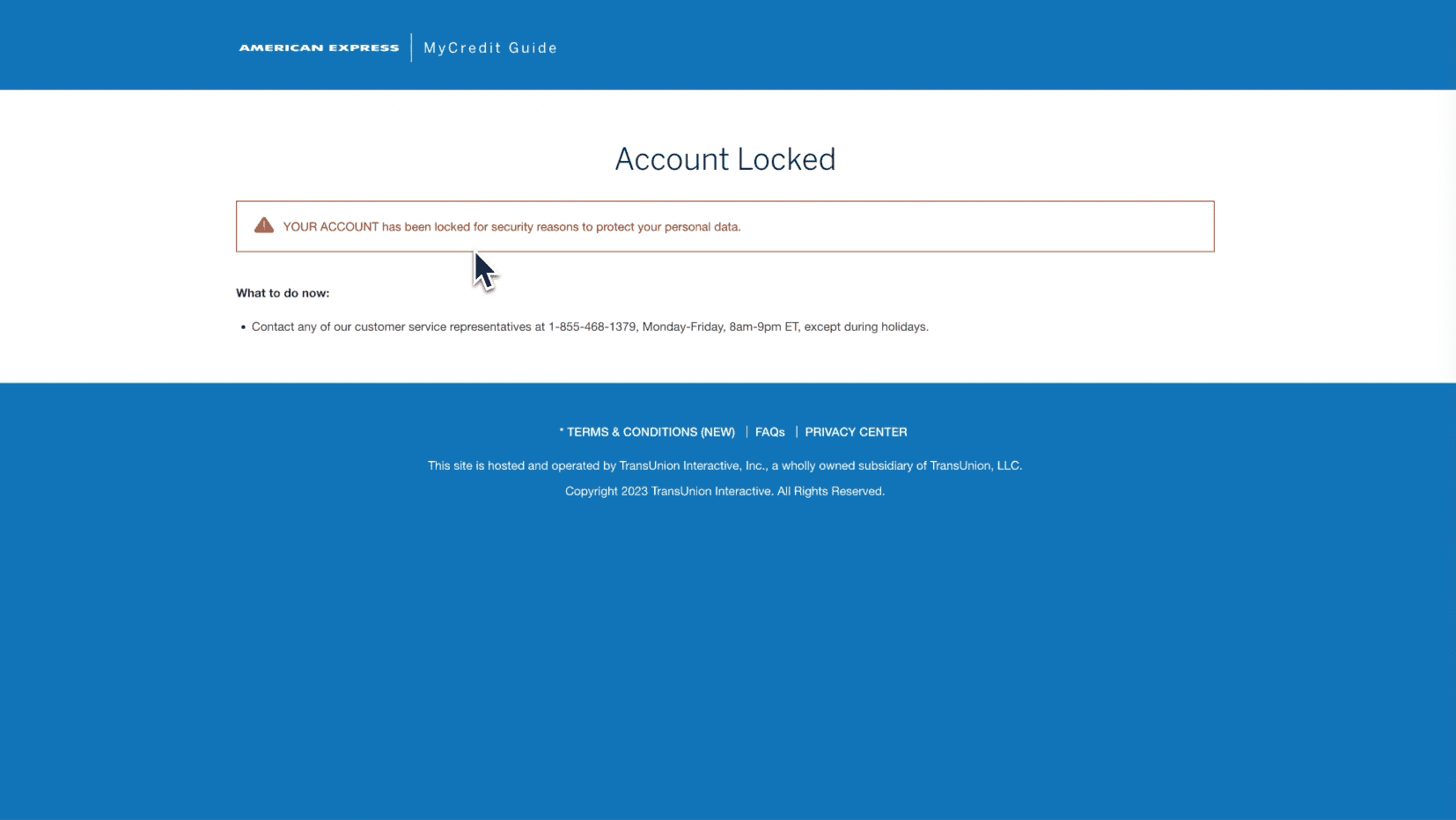

The home page reminds us that we can check credit report records for free, but according to my actual test, after clicking here, it will prompt that the account is locked.

When I saw this prompt for the first time, I was so frightened that I broke into a cold sweat and wondered why my account had been blocked!

But in fact, there should be a problem with his viewing entrance. We can't see it when we click on online banking, so how can we check it?

We can check our credit record through the mobile APP, and we will also demonstrate it to you below.

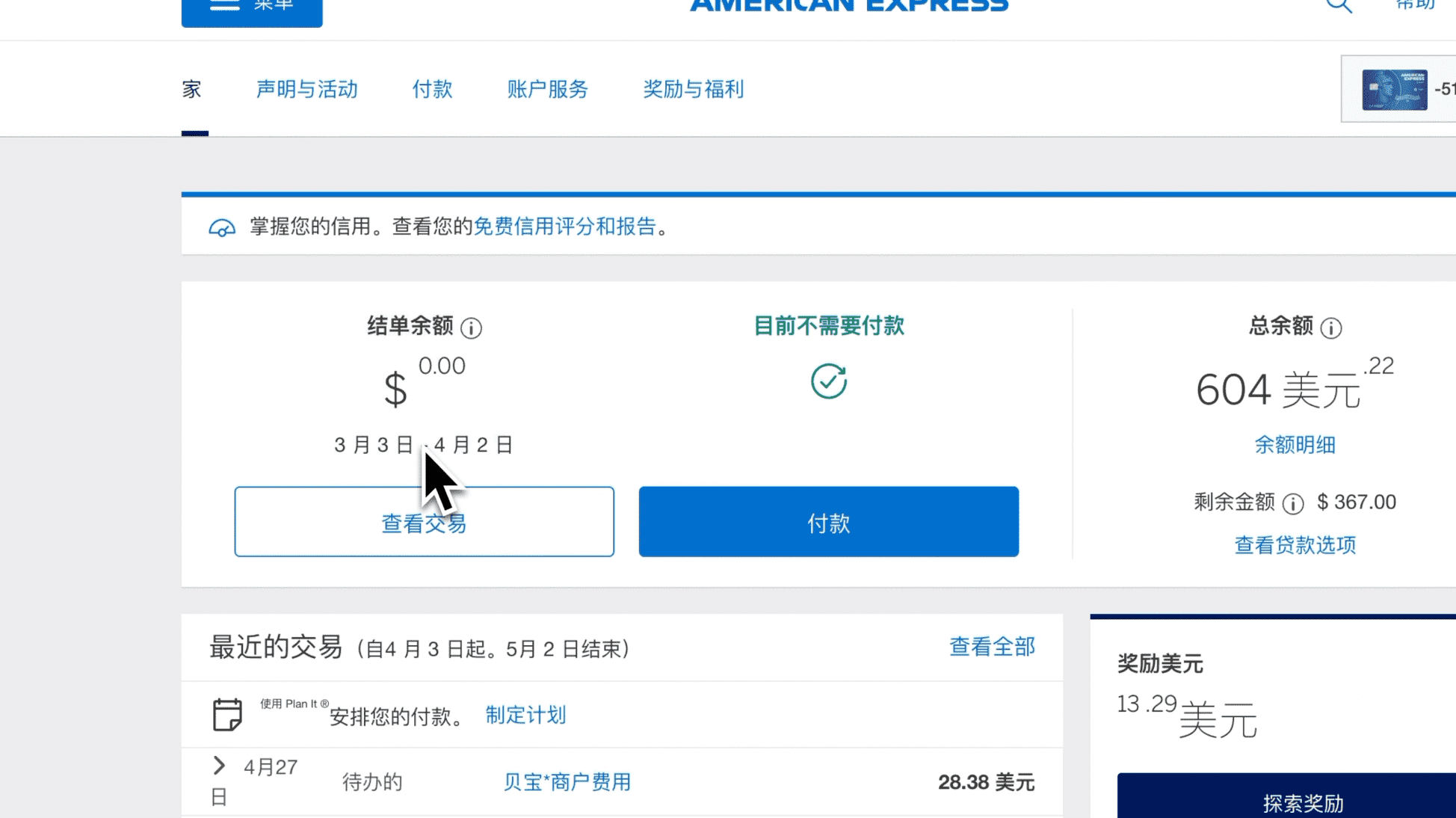

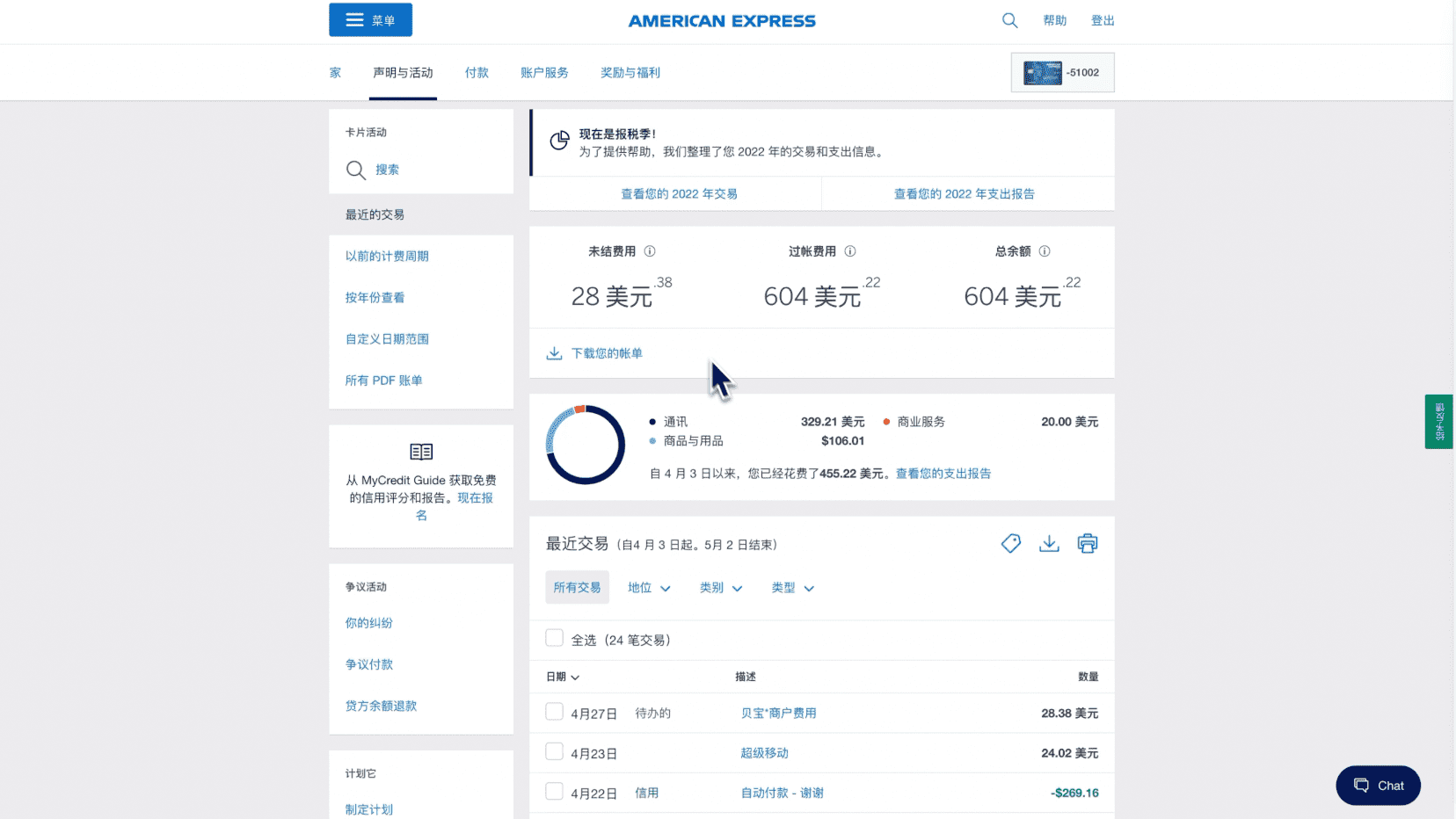

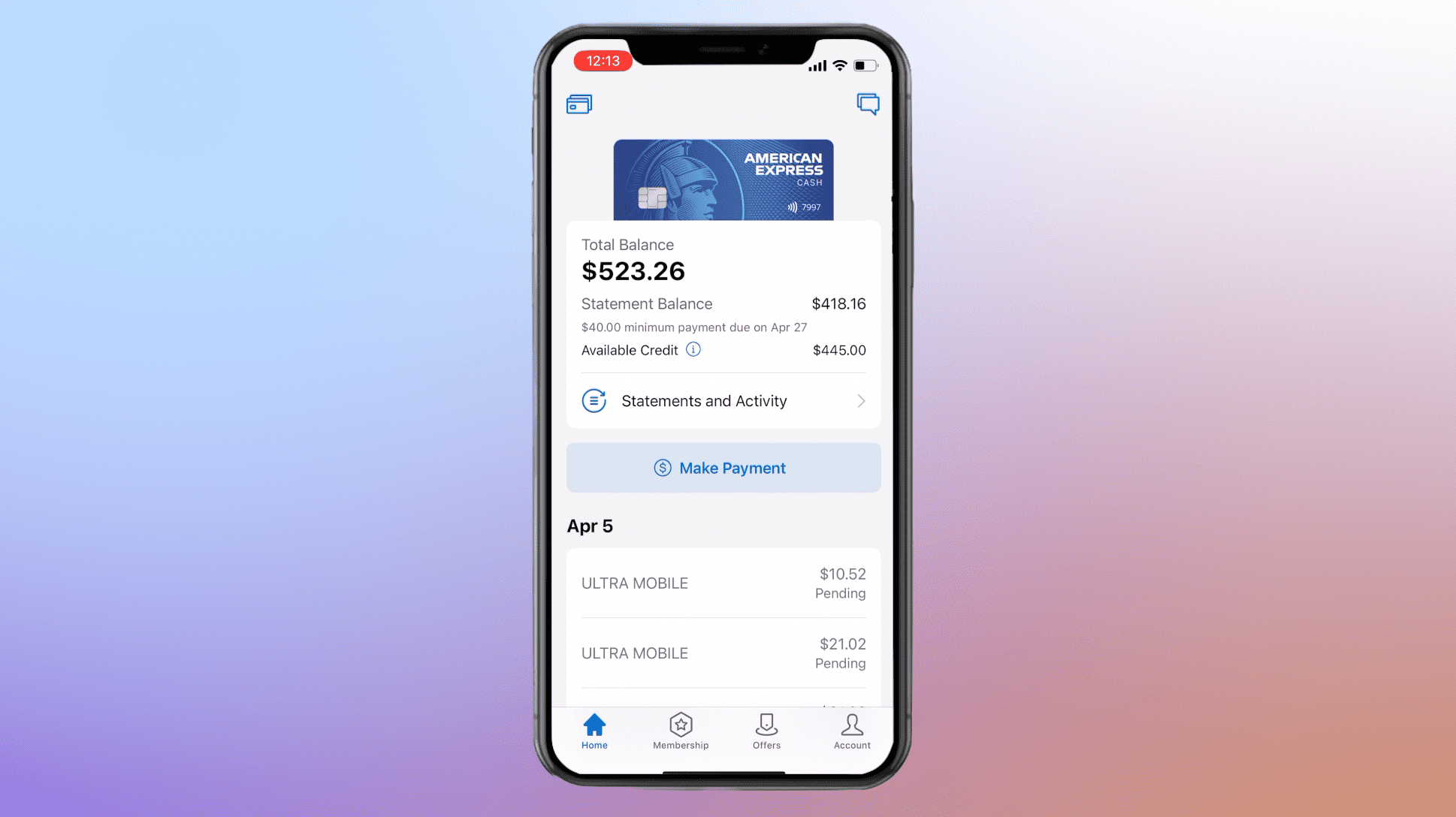

Let’s continue with the computer version of online banking. Here you can see your current credit card balance, how much you need to pay back, and how much credit is left.

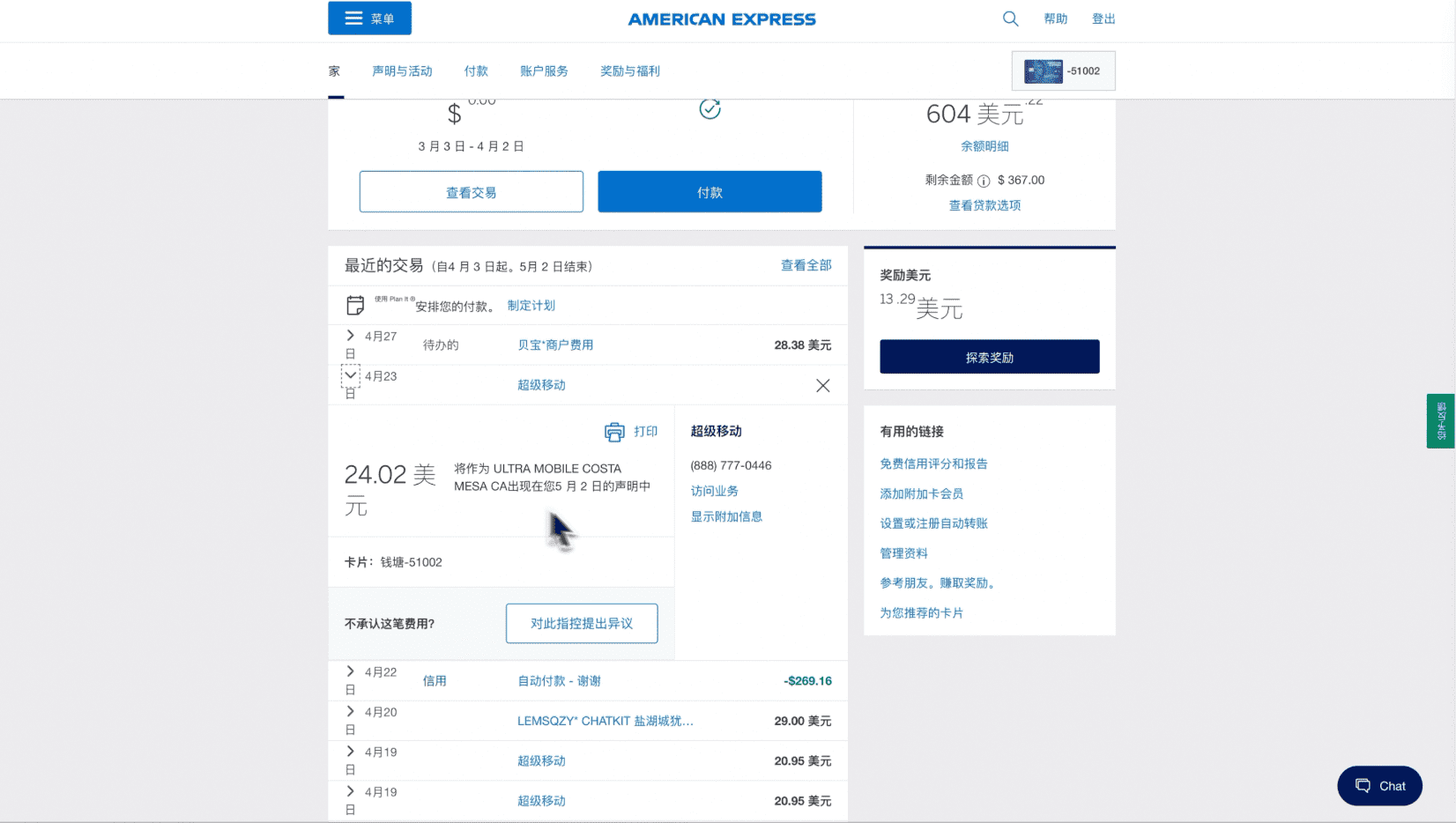

Below you can see a recent transaction record, here you can see the amount of cash back, click on each transaction record, you can see the details of the specific consumption, if your card has been stolen, you can click here The feedback was that they did not recognize the money and initiated a dispute.

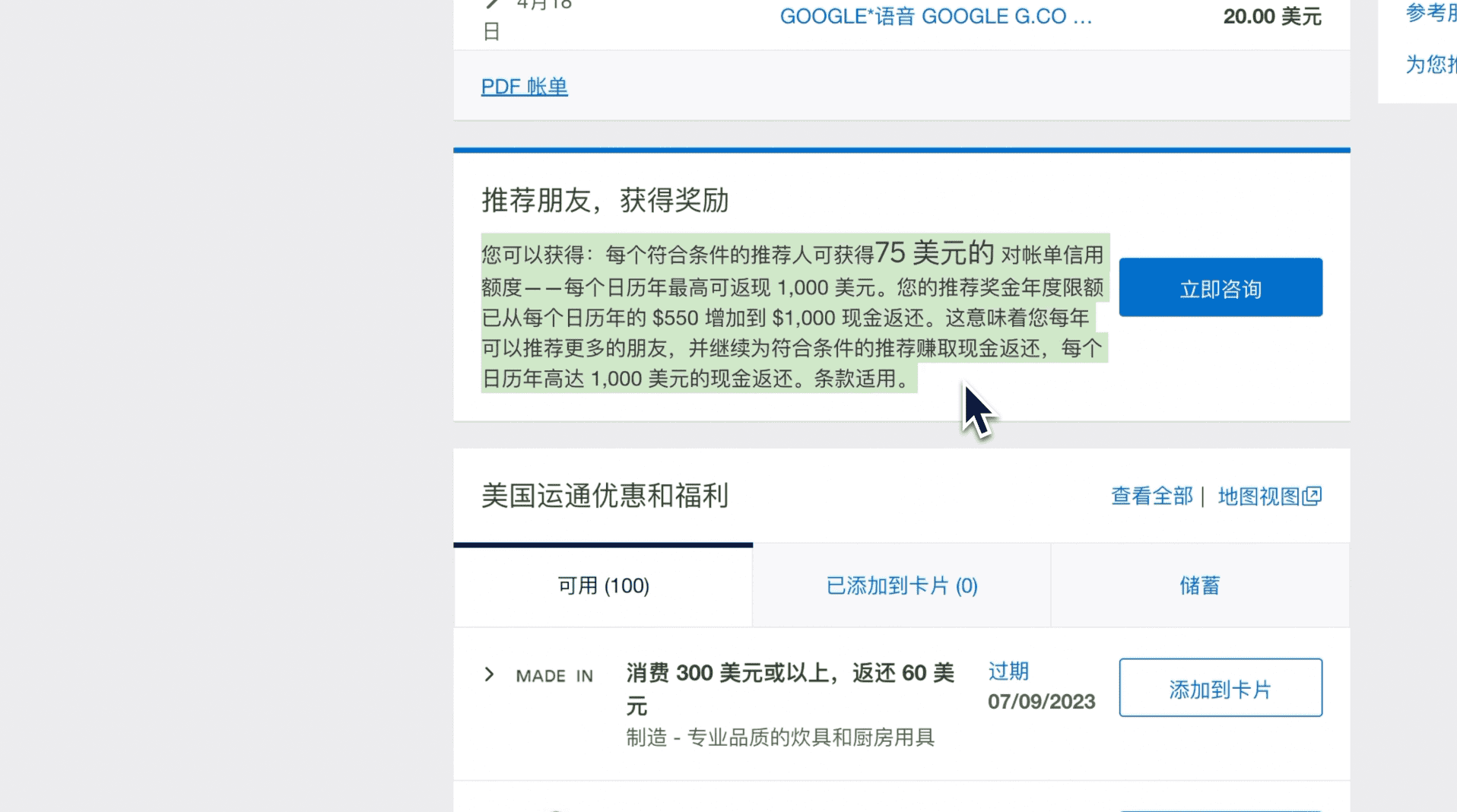

There is a recommendation plan below. If , you can also get a cash rebate after successful registration. You can also recommend it to your relatives and friends to earn cash back.

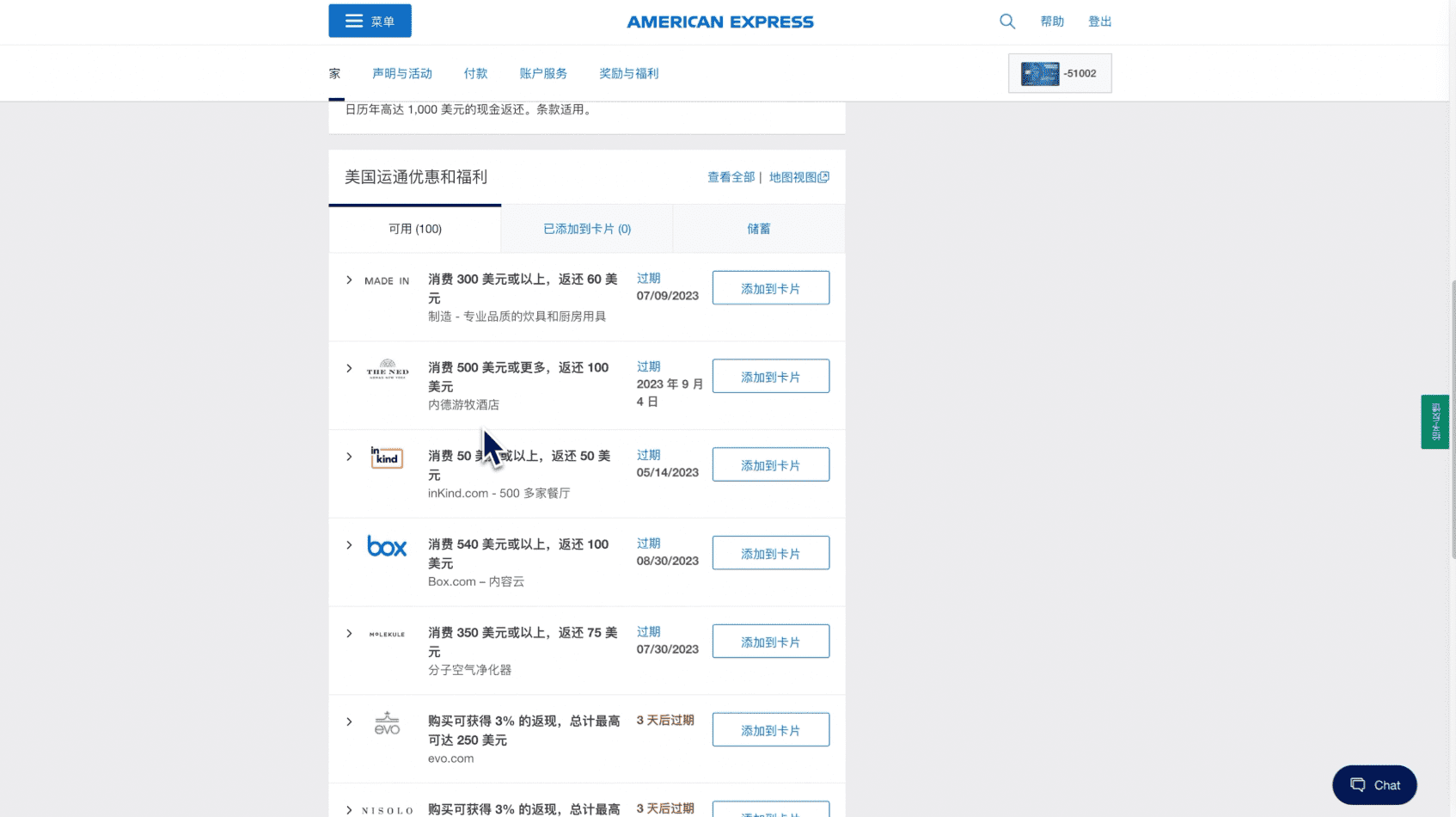

The following are some offers that can be added to our cards. If you spend on these platforms, you can get corresponding discounts.

In the second menu, Activities and Statements, we can see the transaction details of our bills, and we can also click to download our past bills.

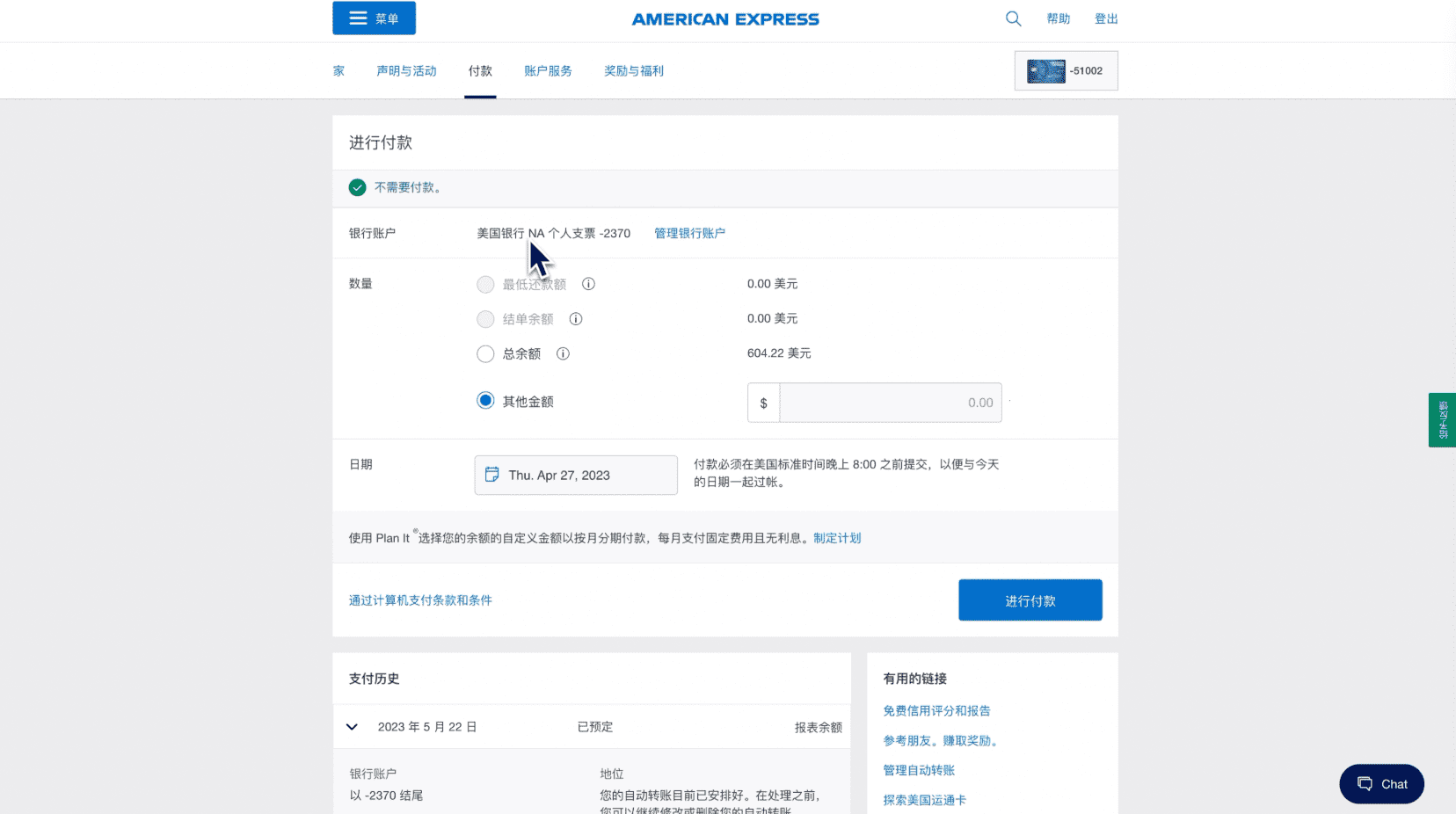

The third menu, payment. If you pay, it is actually a credit card repayment.

Another point is that before you apply for a U.S. credit card, you must have a U.S. checking account. Otherwise, after applying for a credit card, you will have no way to repay the money. Whether it is a virtual bank or a physical bank, you can basically operate it. Credit card repayment.

The one I linked here is a Bank of America checking account.

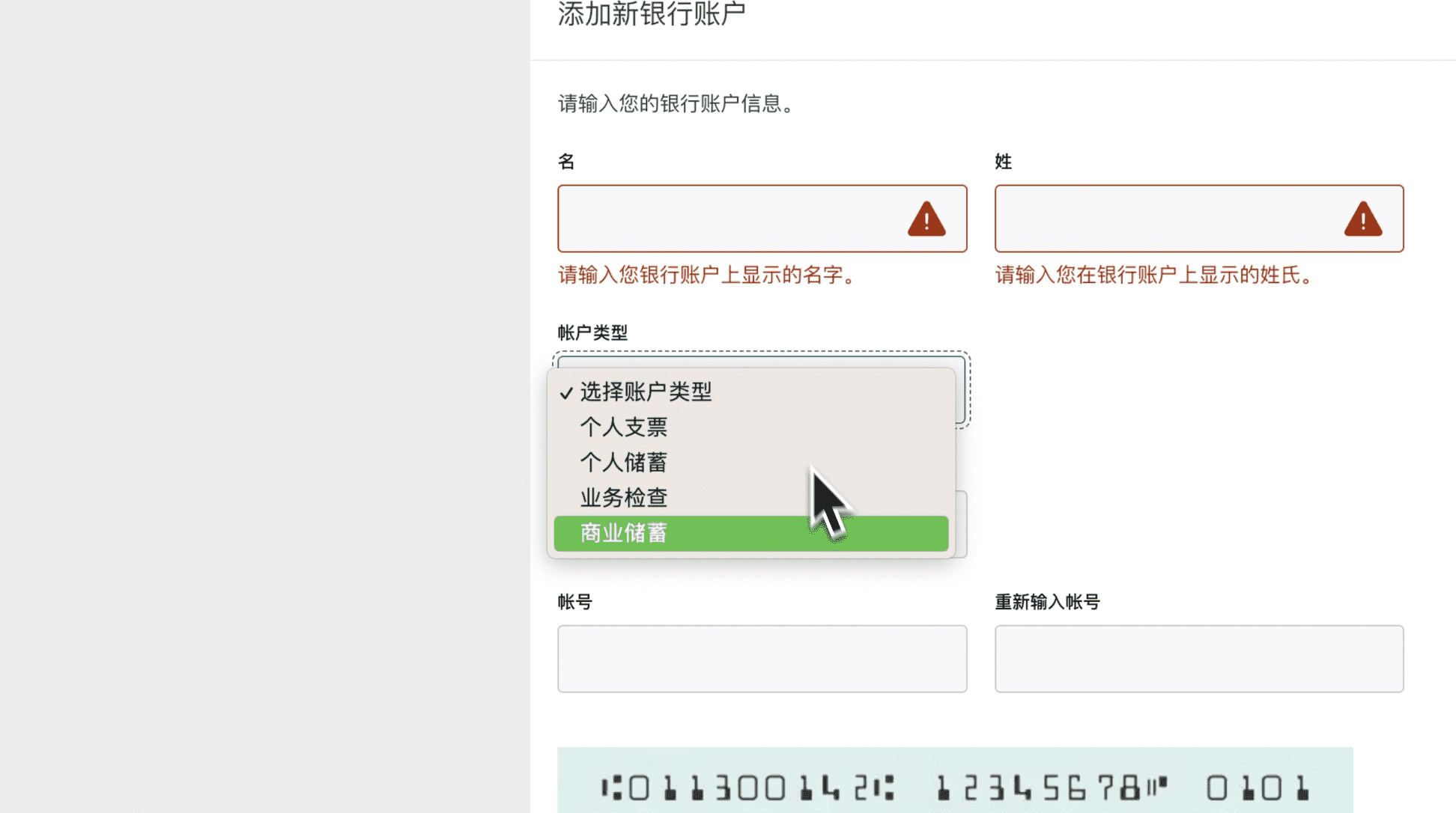

We only need to click Add Bank inside, and then enter the personal account information, and the binding will be successful.

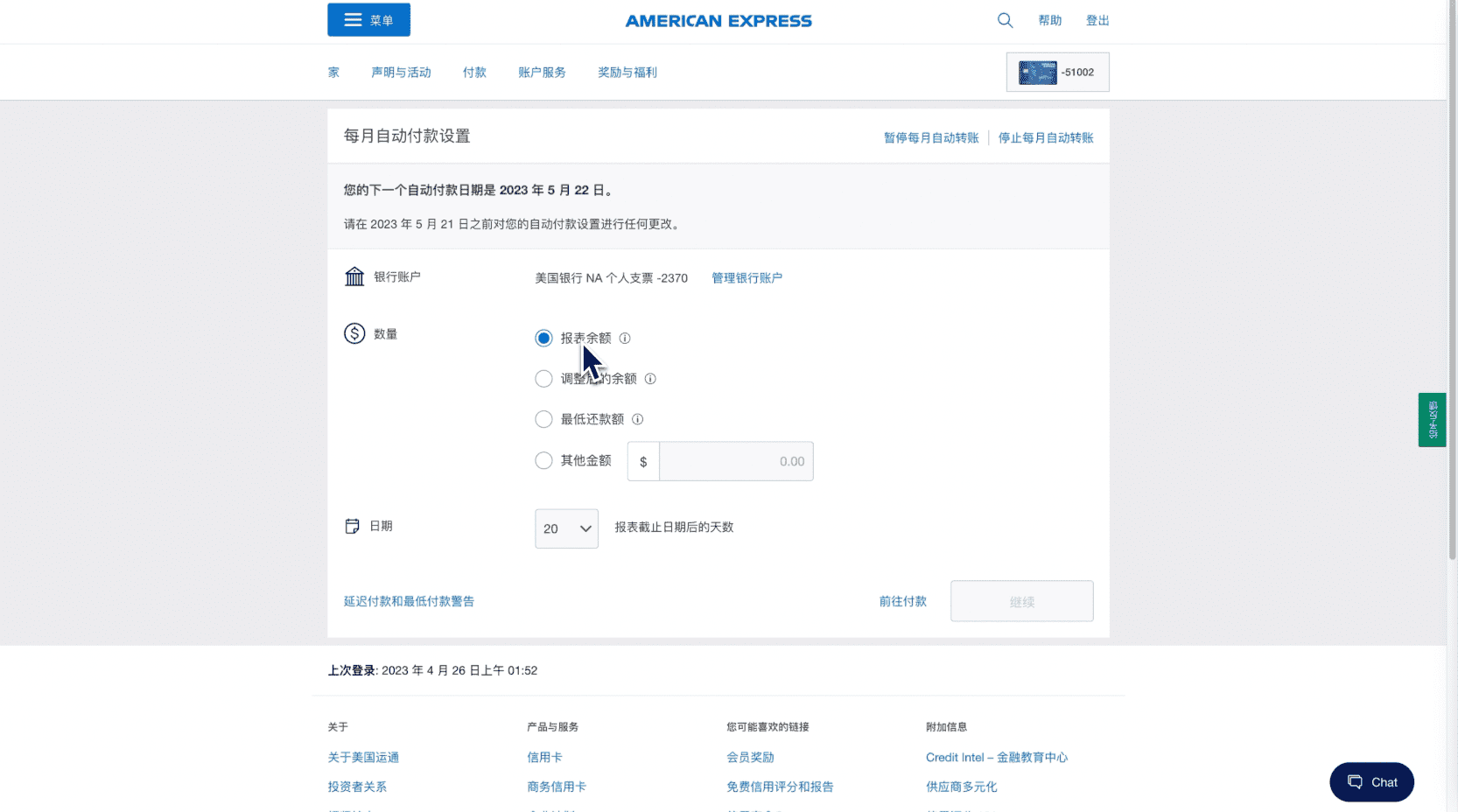

Next, we can set up automatic repayment, so that we will not miss any repayments. We choose to repay all the bill amounts. The next date is the number of days after the bill is issued, and the automatic deduction is made. If it is the latest It is 25 working days, so I choose 20 days.

After setting it up, we can also manage automatic payments here, pause or stop them.

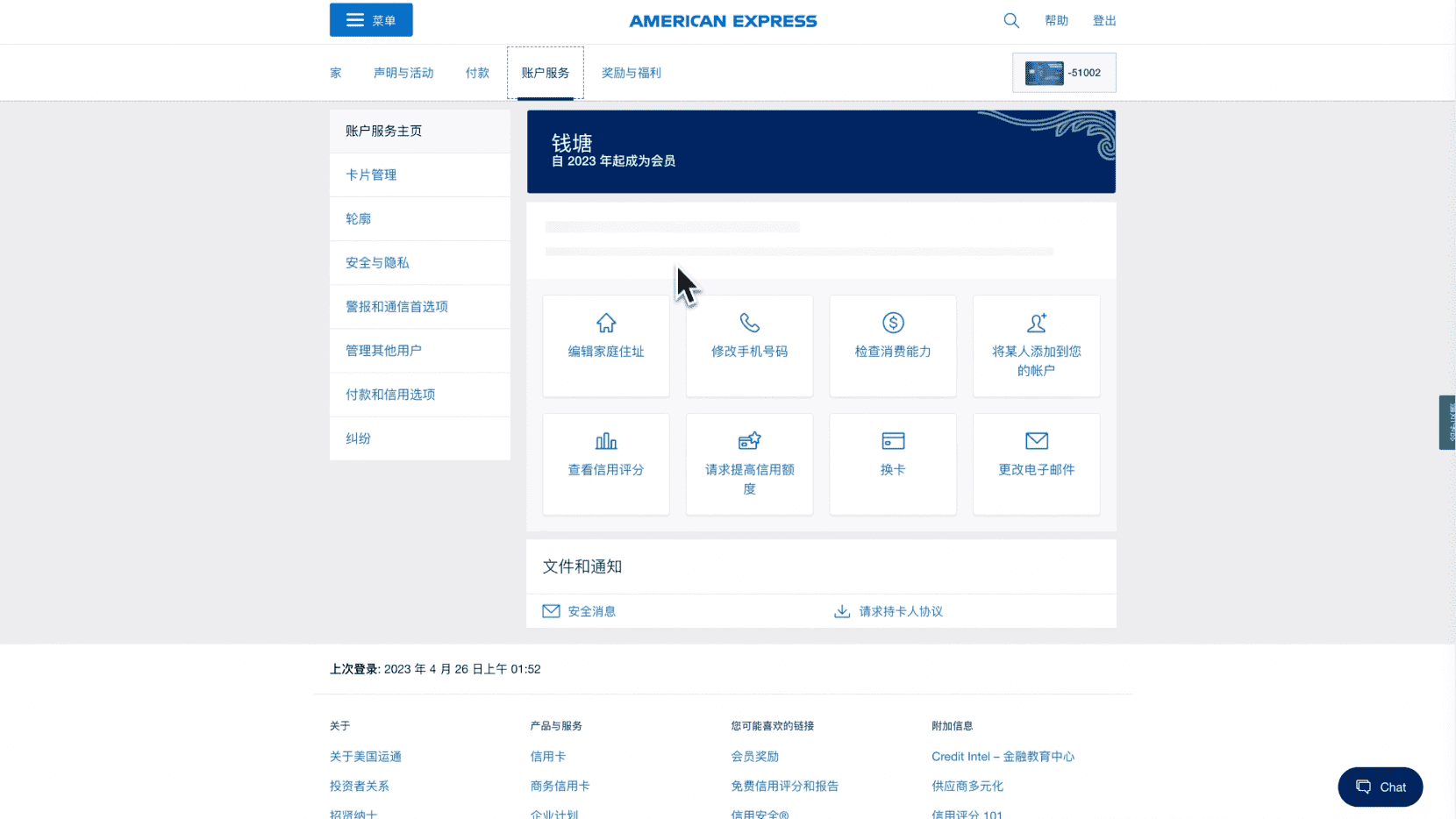

Next, account services.

You can change your home address, change your mobile phone number, and increase your credit limit. You can check these out for yourself. There are no particularly complicated functions.

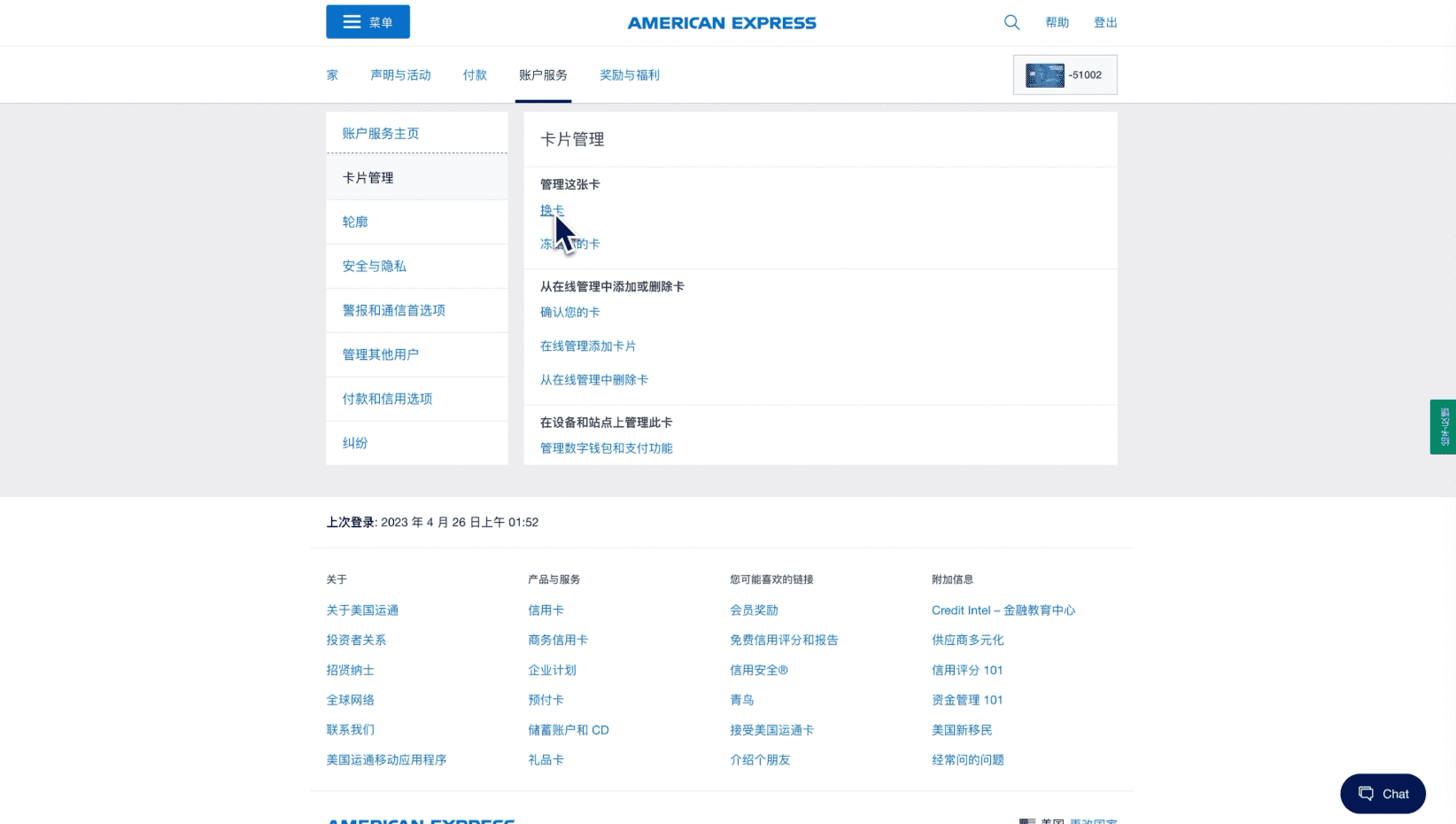

In the card management below, you can change the card and freeze the card, or apply for a new card and add it again.

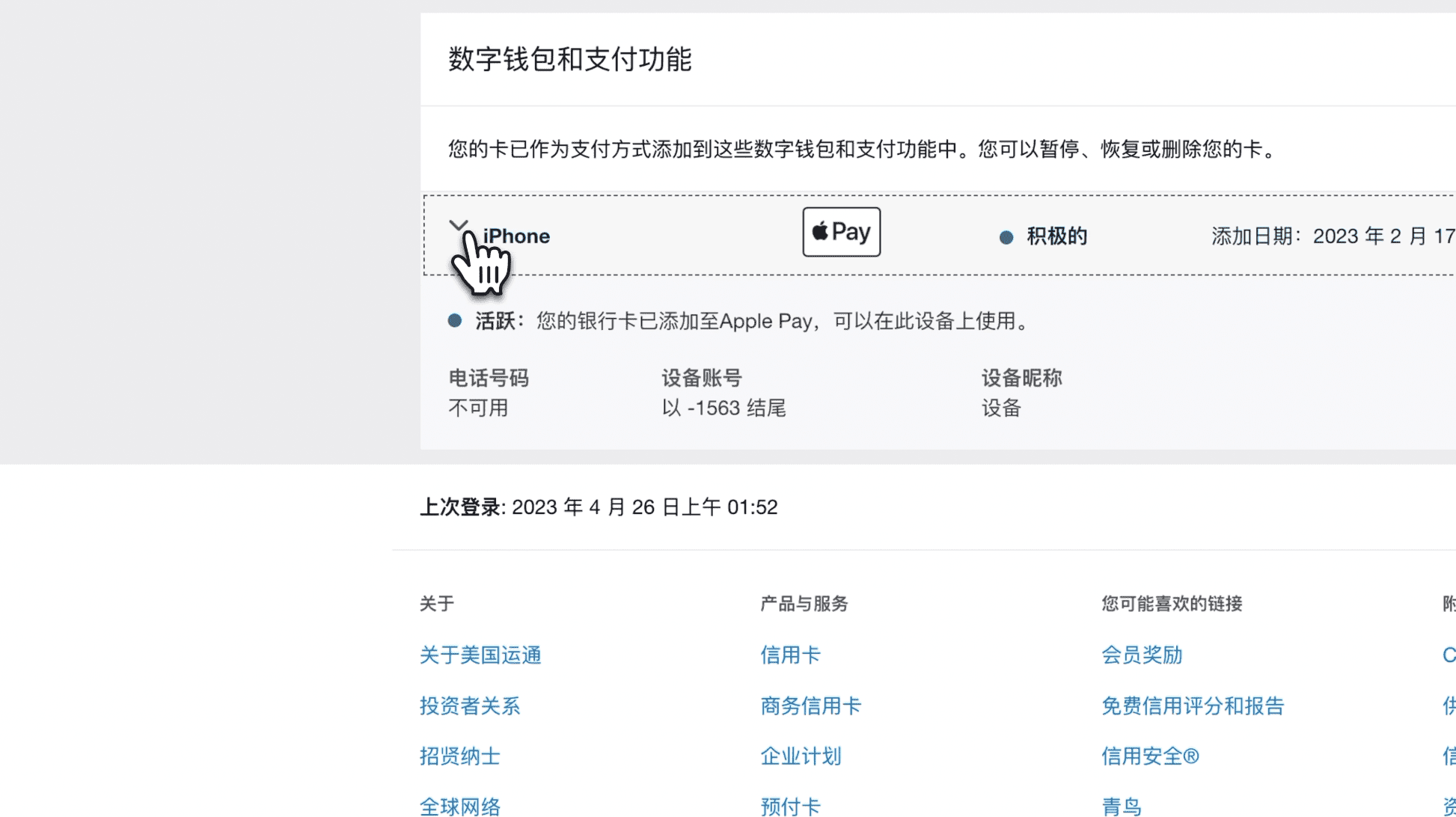

To manage a digital wallet, you can add this card to Apple Pay or Google Pay for consumption.

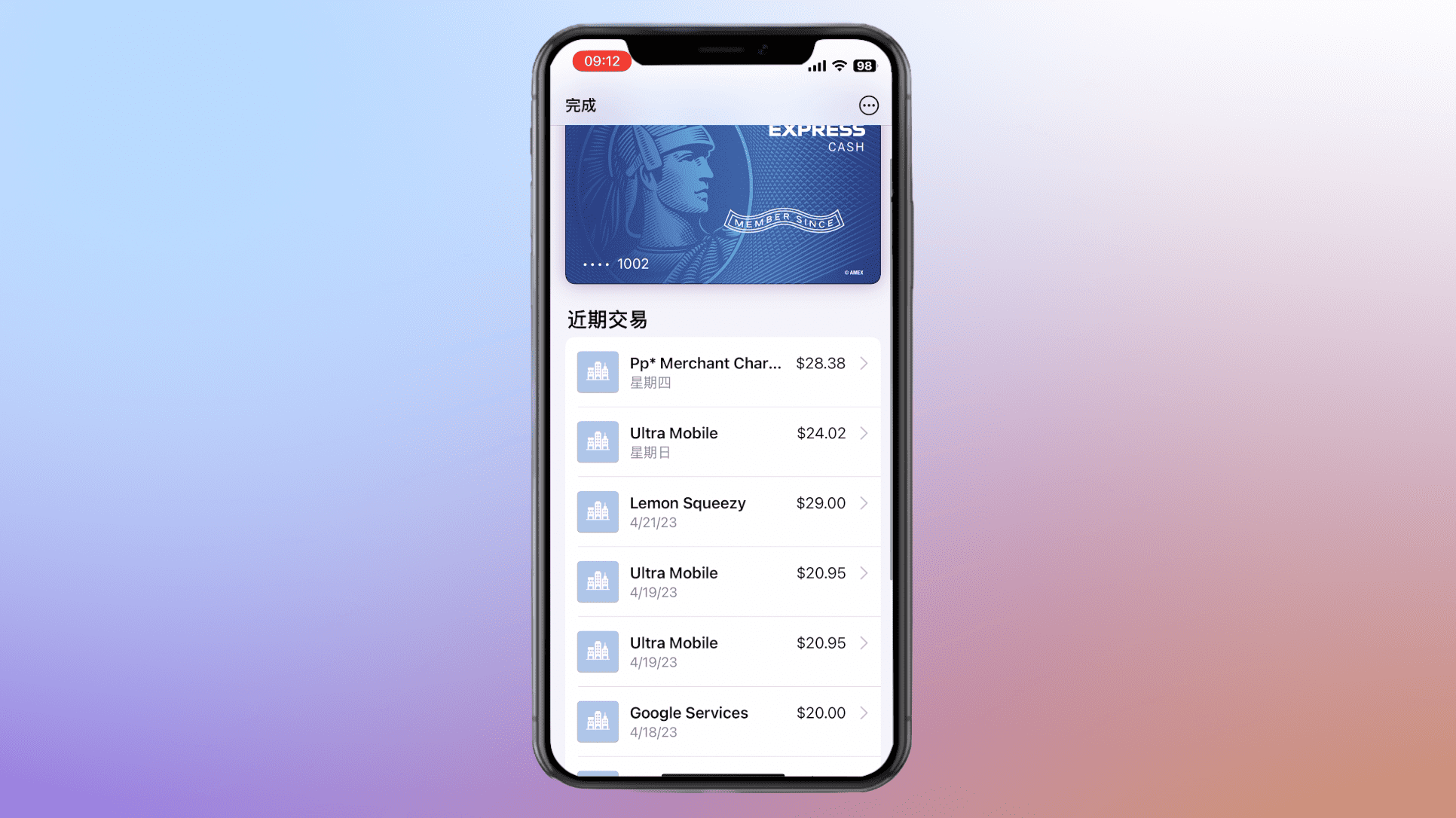

What I added here is Apple Pay. After the addition is successful, Apple Wallet will pop up to prompt us for every purchase. Even if the payment is not made with Apple Pay, it will prompt us. The experience is very good.

Next for security and privacy, it is recommended that you set up two-step verification, so that if you log in with a strange device, you must enter the SMS verification code or email verification code before you can log in. To protect the security of our accounts.

As for payment and credit options, you can actually take a look at these functions yourself, so I won’t go into details.

Similarly, when you click on the credit score here, an error will be reported. If you can't see it, you can only check it through the mobile APP.

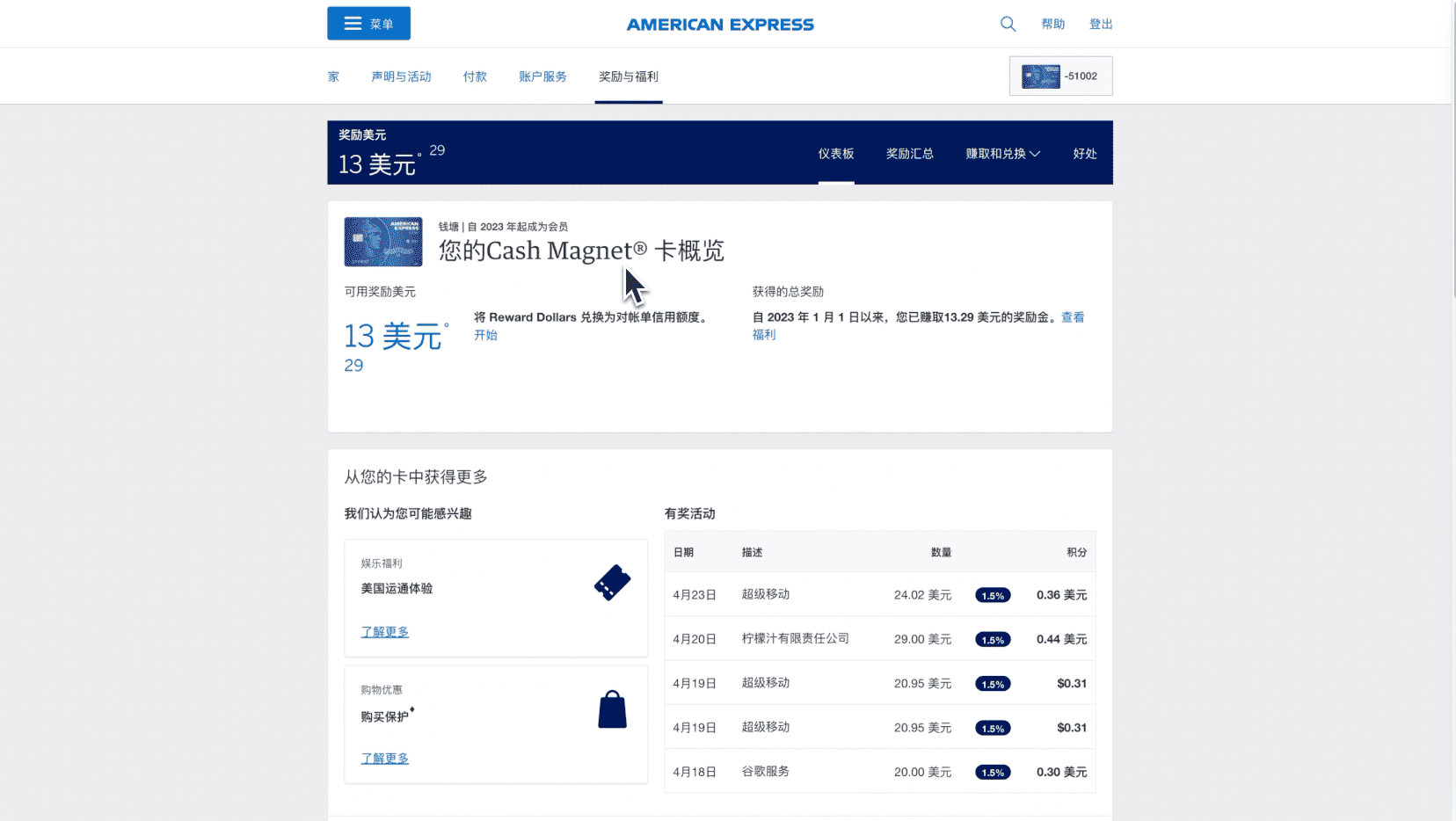

The last reward and benefit.

That is, we can see the amount of our current cash back. We can see the amount of cash back for each purchase. You can see it here. The cash back can be directly deducted from the credit card bill. You can Do it here.

American Express Mobile Banking Tutorial

After successfully logging in, we can see the balance of our bill, available quota, and some transaction information on the homepage. Click here Bills and Activities, you can actually see our billing records. It is also very convenient to pay your bills.

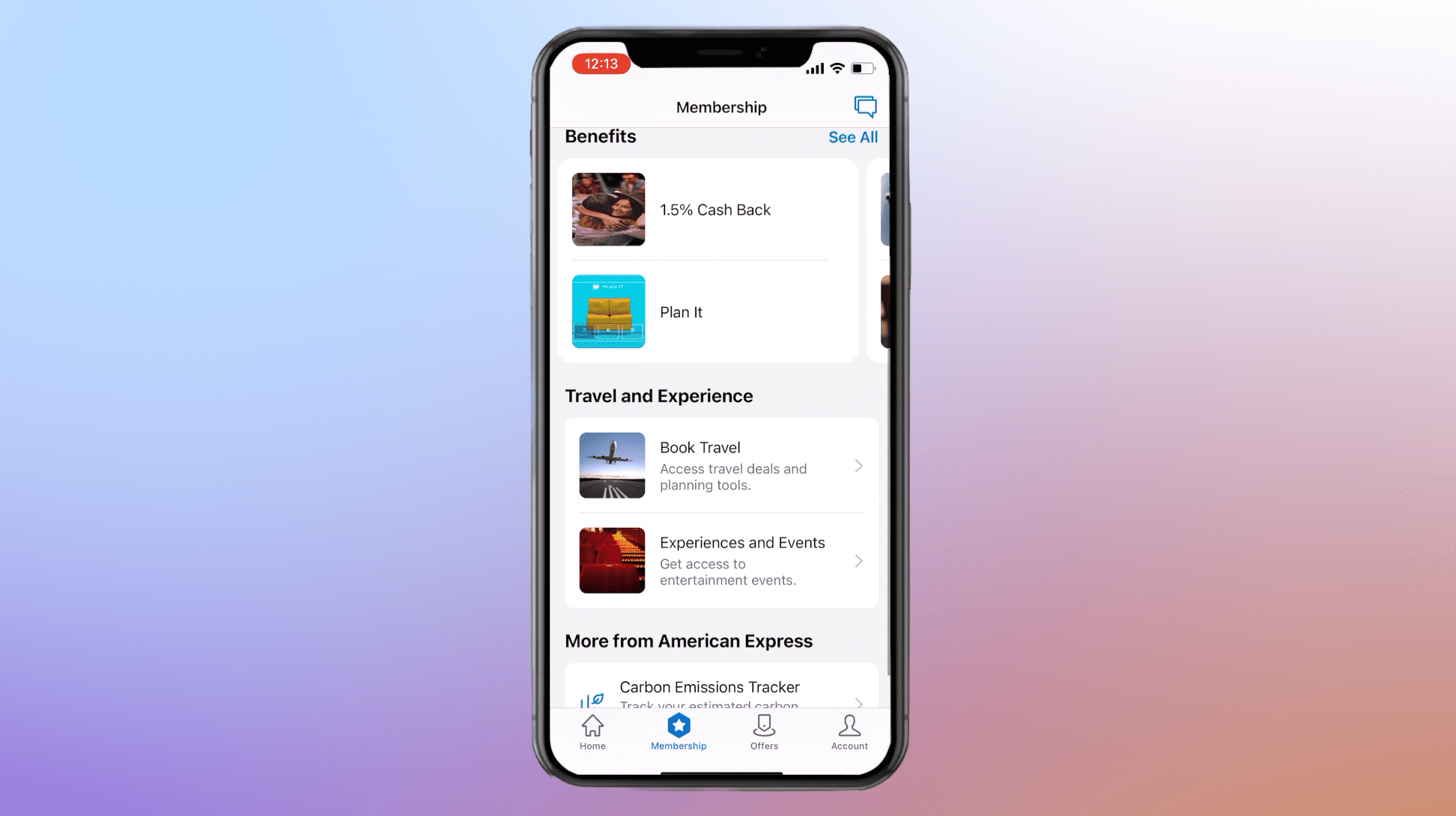

The second menu is membership, and the third menu offer is actually some discount information. The discount offer is useful if you travel to the United States or shop on some online platforms in the United States. You can choose the corresponding offer and add it in advance, and then you can enjoy the discount when you spend on these platforms.

The last section of account information is actually very similar to the options of online banking.

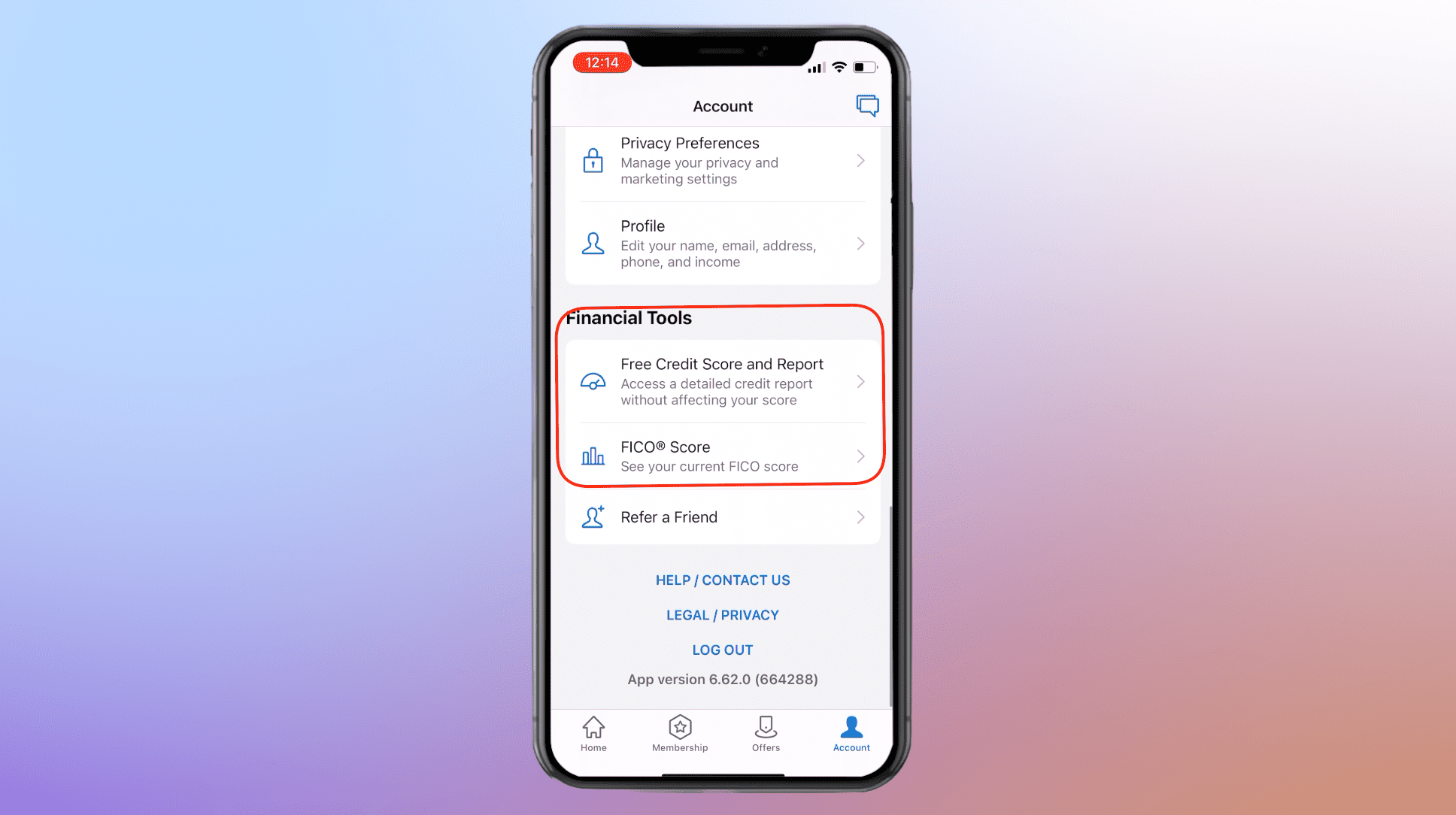

To focus, we scroll down to the end and see a financial instrument.

The first one is a free credit report. If we click on it, it will report an error. We can only click on the second one, FICO score. Click in and you can see our U.S. credit history.

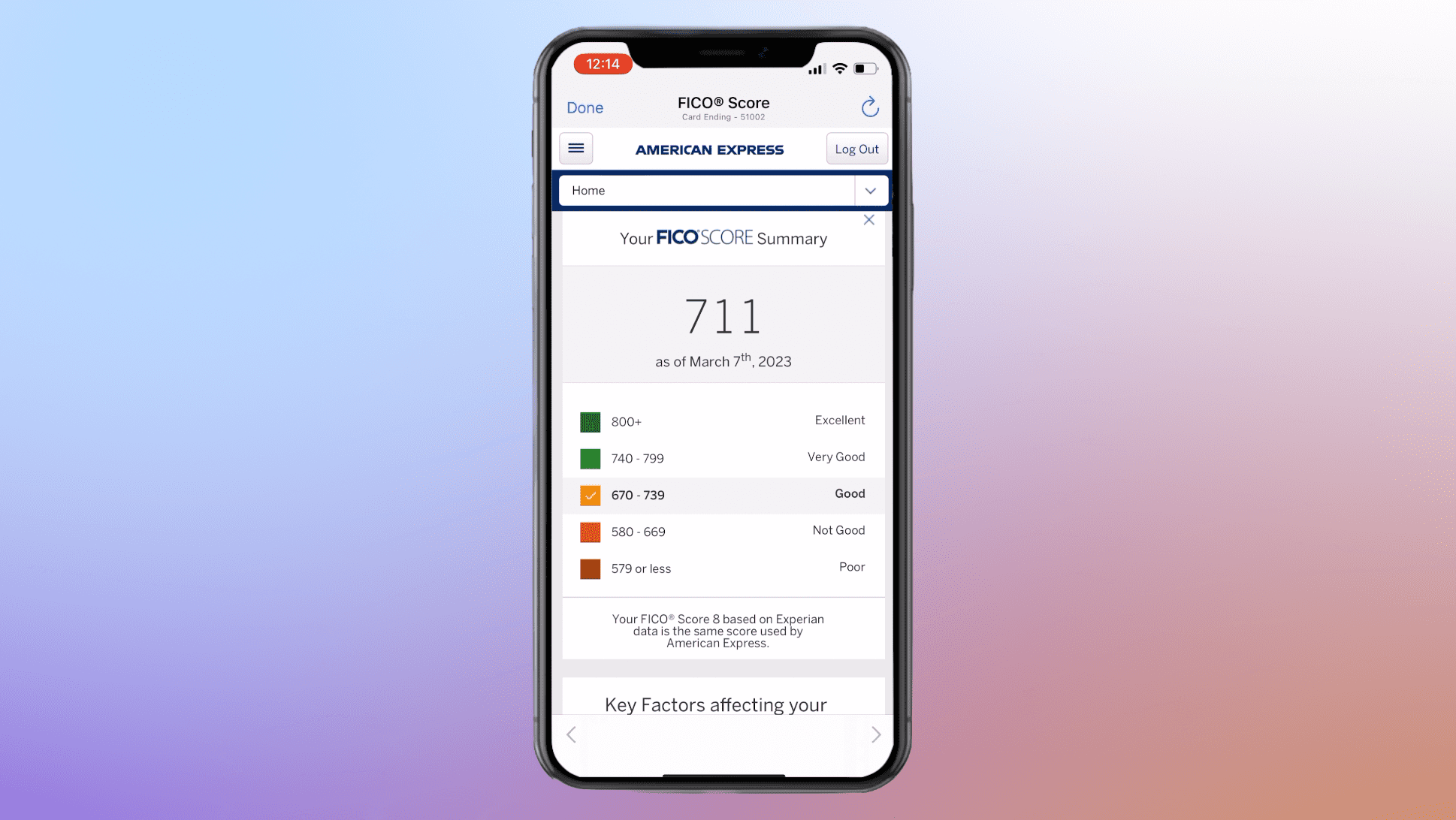

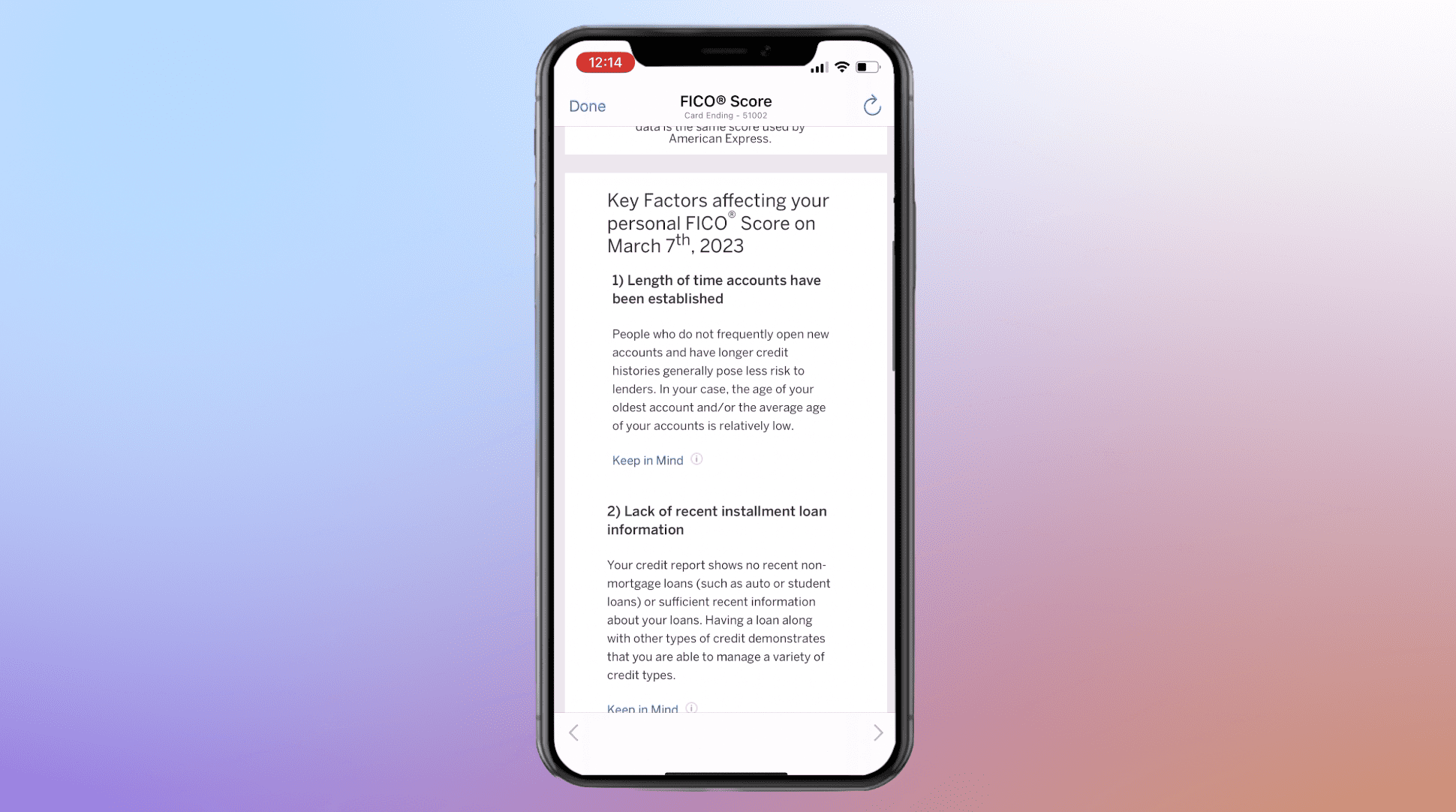

My credit record here is 711, which is a good level. Below you can see some of the reasons that affect the score.

There is no limit to the number of inquiries on this credit record. You can come in and inquire every month, and it will not have any impact on our credit record.

The above is the application demonstration tutorial for and the operation demonstration of . I hope it can help you.

If you want to apply for or , but don’t have , , or an , then don’t worry, you can contact me to help you customize a complete set of operation plans.

Thanks to the following partners for supporting this article: