TangTalk和他的朋友们

EIN US tax number agency application, individuals from mainland China can apply, and the number can be issued within a week

EIN US tax number agency application, individuals from mainland China can apply, and the number can be issued within a week

Couldn't load pickup availability

What is EIN/147C?

Refer to the official introduction of stripe:

Documents required for application:

Countries of business:

Applicant's Name:

US Address:

Apply for a company name, and fill in your own name for personal application:

Is the applicant a limited liability company:

Business Type:

Business start time:

Application can be completed within one week

EIN Instructions

Today I would like to share with you some common questions about the US EIN tax number:

- What is the use of US EIN?

- How to apply for an EIN for free?

- What information is needed to apply for an EIN?

- How long is the EIN valid for and how can I extend it?

- What is 147C and what is it used for?

- Do I need to file taxes if I have an EIN?

What is an EIN used for?

The only official use of EIN is for tax filing.

Every year when companies or individuals file taxes with the IRS, they must provide EIN to verify their identity. At the same time, if our US company needs to open a US company bank account, it must also provide EIN to the bank as identity verification. The same is true when we use EIN to apply for a Stripe account.

Using EIN as a proof document tells Stripe that we are a legal organization in the United States and that we are eligible to apply for a Stripe account to collect payments for the company's business purposes.

Can I apply for an EIN if I don't have a business?

The answer is yes. In addition to companies, individuals can also apply for EIN . Individuals apply as freelancers or self-employed individuals, and the EIN header is our name.

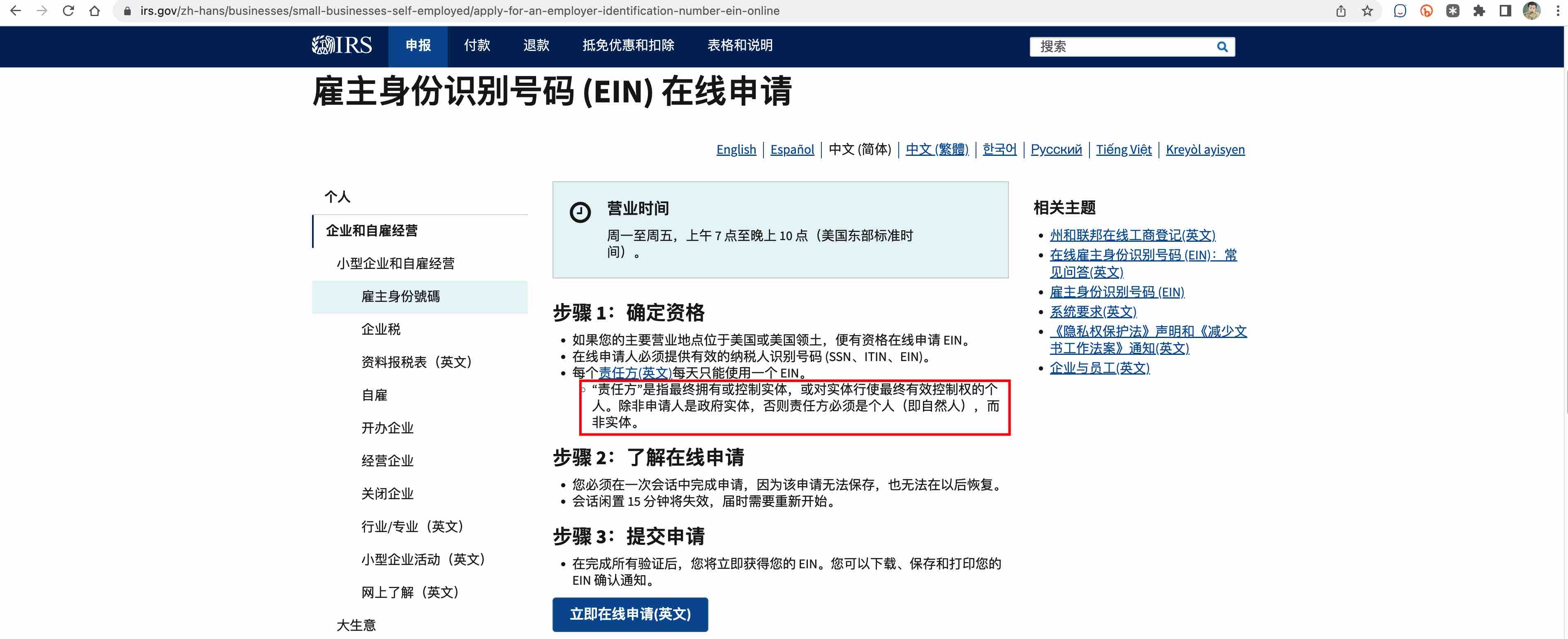

How to apply for EIN?

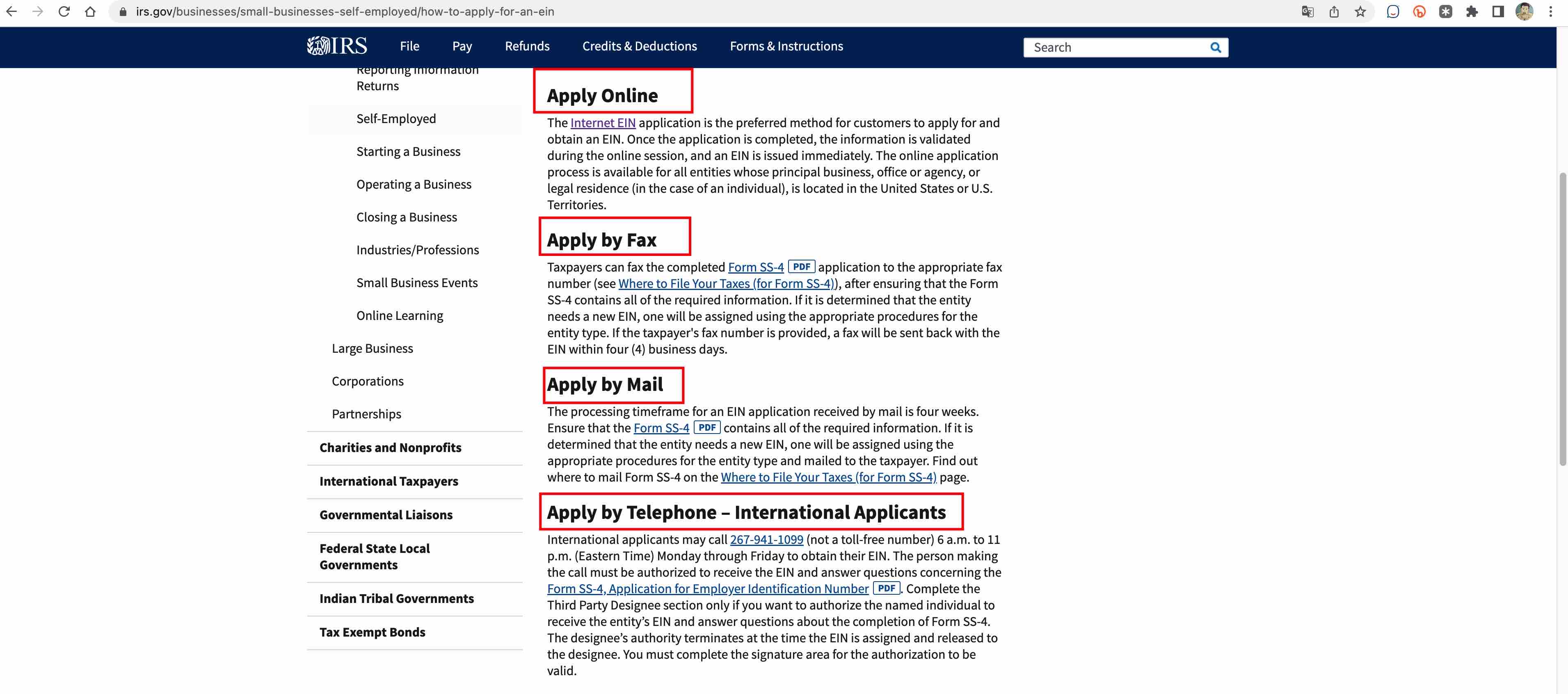

The IRS provides a total of 4 application methods.

The first method is to apply online. We only need to fill out the W4 form on the IRS official website to successfully apply. However, this method requires us to have an SSN or ITIN , which is not practical for us mainlanders.

The second and third methods are to apply by mail and fax, which means you need to download the w4 form from our IRS official website , and then fill it out and mail or fax it to the IRS. This method requires you to have relatively professional American accounting knowledge and know how to fill out the w4 form.

The fourth way is to apply by phone. You can call the IRS directly and answer the staff's questions about the W4 form on the phone. You can get the EIN number on the spot. This is the method I recommend most, but this method first requires you to have good English, and secondly, it also requires you to have professional accounting knowledge and be able to fill out the W4 form.

There may be many friends who do not have professional accounting knowledge and cannot fill out the W4 form. At this time, we can find an American accountant to assist us in the application.

How much does it cost to apply?

First of all, all four application methods on the official website are free. If you are good at English and can fill out W4, you can just go to the official website to apply, it is completely free. You only need to pay for the phone call, mailing and faxing.

However, if you cannot apply on your own and need to find a professional American accountant to apply, you will need to pay an American accountant's fee. This fee is basically around RMB 300-500, depending on the accountant. If you need a 147C confirmation letter, the fee will generally be around RMB 100 more.

What information do I need to prepare for the application?

In fact, the application threshold for EIN is very low. For example, the American accounting channel here only requires the applicant's name, address, phone number, and email address. As well as the purpose of applying for EIN , these information are enough. No documents such as passports or ID cards are required. For address and phone, we can use the domestic address, not the US address and phone number.

When is the EIN effective date?

The official statement about the EIN number is that it will take 14-21 days, or two to three weeks, to check and use online. The actual situation is that when applying for Stripe , if you apply immediately after getting the EIN number, you will be approved immediately.

Of course, if some friends encounter the situation that the system cannot recognize the EIN they fill in, they can wait 14 days until the EIN officially takes effect and apply again.

In addition, 6-8 weeks after the EIN application is successful, our mailing address will receive the EIN confirmation letter from the IRS. Domestic addresses can also receive it. However, because it is an international surface mail, there is a possibility of loss.

How long is an EIN valid for?

The validity period of EIN is three years. If you do not file your national tax return within three years, the EIN will become invalid. However, if you file your tax return in one year within three years, the EIN will be valid for another three years.

How to verify the authenticity of EIN?

At this time, we need to call the IRS, provide our name and address, and then we can check and verify the EIN number under our name.

Will there be any impact if I apply for an EIN but don’t file taxes?

First of all, filing taxes is the obligation of every individual or business. If you have a long-term physical or virtual business in the United States, it is a wise choice to file taxes every year.

If you apply for an EIN just to open a Stripe account or apply for a virtual credit card, then not filing a tax return will not violate US tax law. However, if you do not file a tax return for three years, the relevant EIN will become invalid. If you are interested in how to file a tax return in the United States, you can email me for consultation.

If I lose my EIN number, how do I get it back?

First, we can find our EIN number on the 147C confirmation letter. If the 147C is also lost, we need to call the IRS and provide our name and address, and then we can check and verify the EIN number under our name.

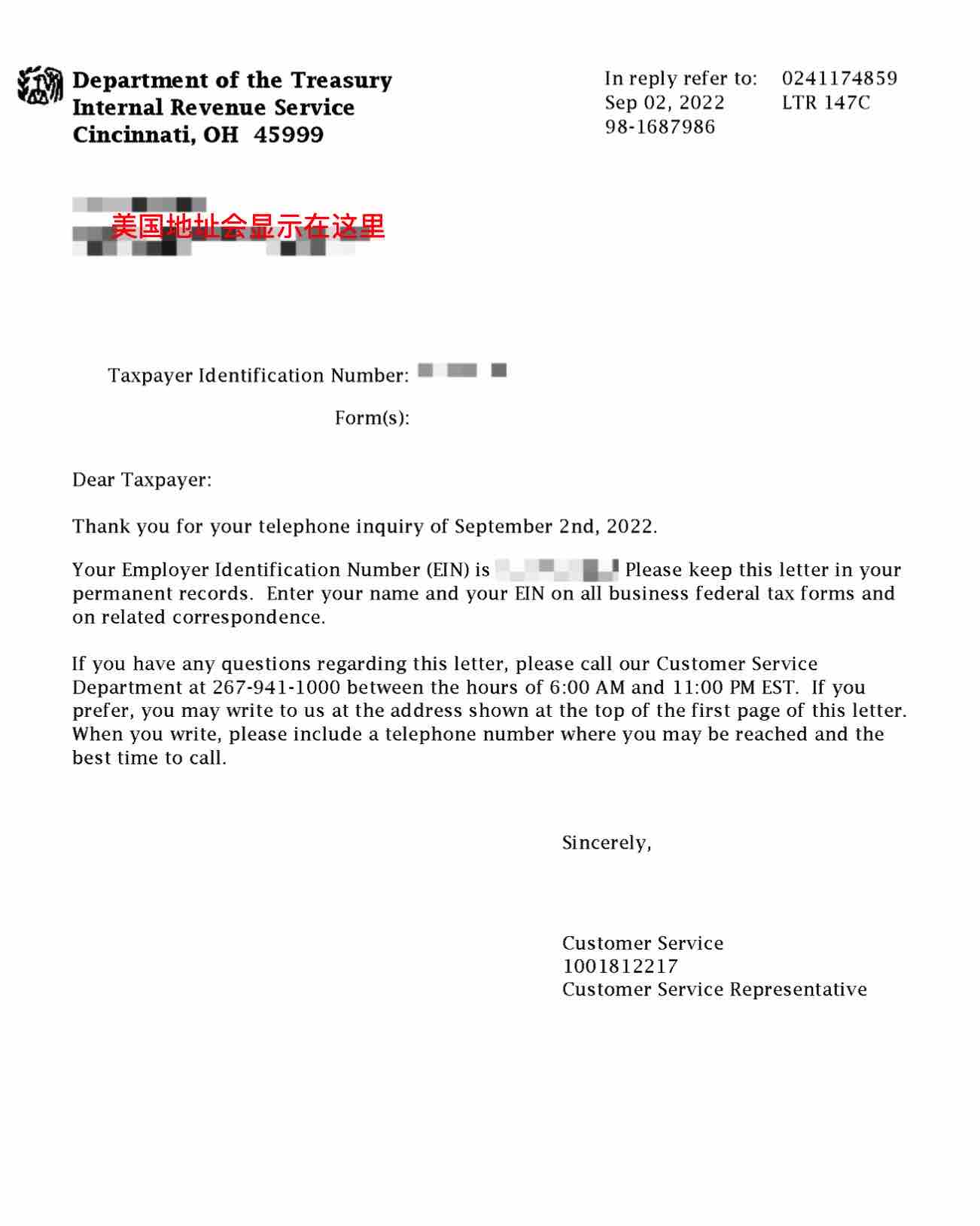

What is 147C?

147C is the EIN confirmation letter sent to us by the IRS. It includes our name and address. EIN number. This letter tells us that the EIN application has been successful.

Some websites may require us to provide 147C to verify the authenticity of EIN . In addition, we can also use this confirmation letter as proof of address to apply for other banks or online services.

Can I cancel my EIN application if I don’t want to use it anymore?

If you don't file a tax return for 3 years, your EIN will be automatically cancelled. There is no need to apply for it again. If you must apply for cancellation, you can state the reason for canceling your EIN . Mail a letter to the IRS.

共有